Trending

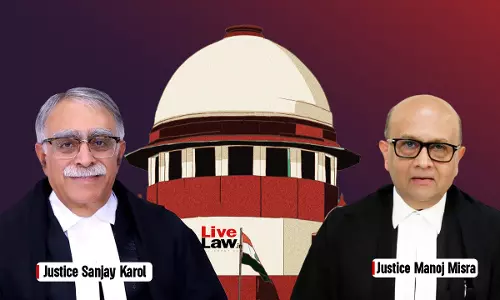

Criminal Revision Filed By Informant Doesn't Abate On His Death; Other Victims Can Continue It : Supreme Court

The Supreme Court has held that a criminal revision petition does not automatically abate upon the death of the revisionist, particularly when the revision is not filed by an accused but by an informant or victim. The Court clarified that in such cases, the revisional court has the discretion to continue examining the legality and propriety of the impugned order and may permit a victim to...

NCLT Hyderabad Clears Kalburgi Cement's ₹213.41 Crore Merger Deficit Adjustment Against Securities Premium

The National Company Law Tribunal (NCLT) in Hyderabad has approved Kalburgi Cement Private Limited's move to clean up a large merger-related loss, treating it as a legitimate internal corporate decision so long as creditors are safeguarded and the statutory framework is followed. A coram of Judicial Member Rajeev Bhardwaj and Technical Member Sanjay Puri has allowed the company to set off...

Bar On Casual Elections Doesn't Apply To 'Indirect Election' Of Mayor Under Greater Hyderabad Municipal Corporation Act: AP High Court

The Andhra Pradesh High Court has observed that elections to the post of Mayor–including election to fill a casual vacancy is an 'indirect election', and the embargo under Greater Hyderabad Municipal Corporation Act would not apply to elections held at the end of term to fill this post. The State Election Commission (Respondent 2) had issued a notification on 04.12.2025 directing the...

Income Tax Act | ITAT Mumbai Grants Major Tax Relief To Vodafone; Deletes Depreciation, TDS & S.14A Disallowances

The Mumbai Bench of the Income Tax Appellate Tribunal has held that multiple additions made by the Assessing Officer could not be sustained in law. The Bench held that the transfer of passive telecom tower assets pursuant to a court-approved demerger amounted to a genuine “gift” under Section 47(iii), and the Assessing Officer could not artificially impute consideration...

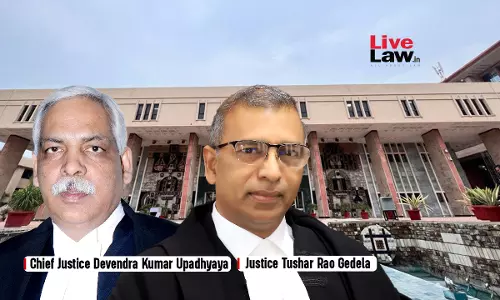

Non-Obstante Clause U/S 13(2) Commercial Courts Act Prevails Over S.10 Delhi HC Act: Delhi High Court Dismisses Arbitral Appeals

The Delhi High Court Bench of Chief Justice Devendra Kumar Upadhyaya and Justice Tushar Rao Gedela while dismissing an appeal under Section 10, Delhi High Court Act (“DHC Act”) and Section 13(2), Commercial Courts Act (“CC Act”) observed that the expression “any other law for the time being in force” used in Section 13(2), CC Act encompasses in its fold the provisions of...

High Court Asks Haryana Govt To File Fresh Affidavit On Teacher Shortage, Infrastructure Adequacy In Govt Schools

The Punjab and Haryana High Court has directed the State of Haryana to file an additional affidavit furnishing district-wise data on government schools strictly in accordance with the norms and standards prescribed under the Right of Children to Free and Compulsory Education Act, 2009.A Bench comprising Chief Justice Sheel Nagu and Justice Sanjiv Berry passed the directions while considering...

SHANTI Act 2025: Sidelining Environment For Private Proliferation

The Parliament recently passed the Sustainable Harnessing and Advancement of Nuclear Energy for Transforming India Bill 2025, now pending President's assent, aiming to accelerate private nuclear expansion in the country's nuclear regime. This will be the first for any nuclear related legislation of the country but at the same time it is neglecting the established environmental regulatory architecture thus presenting a very nuanced relationship between the two. Nuclear energy in all its...

Delhi High Court Bar Association Hosts Third Edition Of 'Fight For Justice Awards 2025' To Honour Litigants

The Delhi High Court Bar Association hosted the third edition of “Fight for Justice Awards 2025” to honour litigants for their cases which have resulted in landmark rulings.The awards were presented by Supreme Court judge, Justice N Kotiswar Singh as the Chief Guest of the function. The award ceremony was hosted at The Stein Auditorium, Indian Habitat Centre. The organizers of the event...

Digitalisation, GIS Mapping And Tech Consultancy For Jal Jeevan Mission Are 'Pure Services', Exempt From GST: West Bengal AAR

The West Bengal Authority for Advance Ruling (AAR) has held that digitalisation, GIS mapping, monitoring, data management and technical consultancy services provided to the Public Health Engineering Department (PHED) in connection with water supply schemes qualify as “pure services” and are exempt from Goods and Services Tax (GST) under Notification No. 12/2017. The...

'Serious Threat To Nation': Rajasthan High Court Rejects Pleas Of Life Convicts Seeking Premature Release In 1993 Train Bomb Blast Case

Rajasthan High Court dismissed the petitions filed by four convicts of the December 1993 serial train Bomb Blast cases presently serving life sentence, who had sought premature release and had challenged the rejection of their representations by the State Government. The division bench of Justice Sudesh Bansal and Justice Bhuwan Goyal observed that while exercising power of judicial review,...

If Not Punished, Sociopaths Like Him May Repeat Offence: Karnataka High Court Convicts Man For Making False Allegations Against Judges

The Karnataka High Court recently convicted one K. Dhananjay, for criminal contempt and sentenced him to four month imprisonment along with fine of Rs. 2,000 for making scandalous and unfounded allegations against judges and judicial institution as a whole. The court directed him to be taken into custody forthwith.The accused was convicted for making false and unsubstantiated allegations...

Punjab RERA Directs ATS to Refund ₹57 Lakh to Two Homebuyers In ATS Golf Meadows Life Style Project

The Punjab Real Estate Regulatory Authority (RERA) has ordered ATS Estates Private Limited and ATS Infrastructure Limited to refund a little over Rs 57 lakh to two homebuyers, after finding that the developer did not live up to its contractual promises concering the ATS Golf Meadows Lifestyle project in Mohali .The order was passed on December 2, 2025, by a coram headed by Chairman Rakesh...