Trending

Customs | Bird Feather Used In Fashion Accessories, Ready-To-Wear Items For Luxury Brands Classifiable As 'Dyed': Mumbai AAR

The Mumbai, Customs Authority for Advance Ruling (CAAR) has held that import of Dyed Feathers, wherein dying activity took place in France was classifiable as 'Dyed Feather' in terms of the General Rules of Interpretation. In a ruling dated December 15, 2025 Shri. Prabhat K. Rameshwaram on classification clarified that imported Feathers were intended for use as ornamental materials...

Elappully Brewery Case: Kerala High Court Quashes Govt Order Granting Preliminary Sanction To Private Company To Set Up Ethanol Plant

The Kerala High Court on Friday (December 19) quashed the government order that gave preliminary sanction to M/s Oasis Commercial Pvt. Ltd. to set up a brewery plant in Palakkad's Elappully grama panchayat.The Division Bench of Justice Satish Ninan and Justice P. Krishna Kumar today allowed a batch of public interest litigations filed by the residents of Elappully. The Bench found that...

Customs Act | CESTAT Mumbai Quashes Aluminium Metal Scrap Valuation Enhancement; Says Rule 12 Safeguards Mandatory

The Mumbai Bench of the Customs, Excise and Service Tax Appellate Tribunal (CESTAT) has set aside orders enhancing the value of scrap consignments merely on the basis of National Import Data Base (NIDB) data and a Directorate General of Valuation (DGoV) circular. A Bench comprising Mr. S.K. Mohanty (Judicial Member) and Mr. M.M. Parthiban (Technical Member) stated that the...

How Netflix–Warner Bros Merger Could Reshape India's OTT Market

When a single platform begins to exercise influence over both the creation and distribution of content, questions of law inevitably follow. Netflix's proposed acquisition of Warner Bros Discovery has therefore attracted attention not just because of business implications but because it represents a defining moment in determining how competition law will treat such acquisitions in digital and creative industries. The consolidation of extensive content libraries, production capacity, and...

Income Tax Act | S.153C Notices Unsustainable When Search For 'Other Person' Initiated After 01.04.2021: Madras High Court

The Madras High Court held that the notices under Section 153C are unsustainable where a search for 'other person' was initiated after 01.04.2021. Section 153C of the Income Tax Act applies when documents or assets belonging to a third party are found during a search, and an assessment is made against that person. Section 153C(3) of the Income Tax Act states that Section...

Highest Individual Sentence Relevant For Deciding Whether Appeal Will Be Heard By Single Or Division Bench: Punjab & Haryana High Court

The Punjab & Haryana High Court has suggested that for the purpose of determining whether an appeal against conviction is to be heard by a Single Bench or a Division Bench, the relevant factor is the highest sentence imposed by the trial court, and not the cumulative total of all sentences awarded for different offences.The Court also held that where a trial court, while awarding...

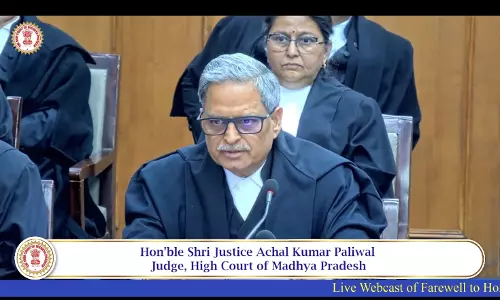

'Destiny Opens Doors, Hard Work Takes You Forward': Justice Achal Kumar Paliwal Bids Farewell To MP High Court

Justice Achal Kumar Paliwal on Friday (December 19) bid farewell to the Madhya Pradesh High Court, bringing a close to a distinguished judicial career spanning 35 years. Born on December 26, 1963, Justice Paliwal joined the MP Judicial Service in 1990. Over the years, he steadily rose through the hierarchy, serving as Civil Jude, Senior Civil Judge and Chief Judicial Magistrate, and...

Rahul Gandhi Citizenship Row | High Court Transfers Case To Lucknow As BJP Worker Alleges 'Death Threats' By Advocates In Raebareli

The Allahabad High Court (Lucknow Bench) on Wednesday directed the immediate transfer of a criminal complaint case filed against the Leader of Opposition in Lok Sabha and Raebareli MP, Rahul Gandhi, from the court of the Additional Chief Judicial Magistrate-IV, Raebareli, to the Special MP/MLA Court in Lucknow. A bench of Justice Brij Raj Singh thus allowed a Transfer Application filed by...

Delhi High Court Upholds Stay On ICC Arbitration In Oman-India Border Security Dispute, Dismisses MSA Global's Appeal

The Delhi High Court has upheld an anti-arbitration injunction issued by a single judge to discontinue an ICC arbitration between Engineering Projects India Ltd (EPIL) and MSA Global LLC (Oman). The Division Bench comprising of Hon'ble Mr. Justice Anil Kshetarpal and Hon'ble Mr. Justice Harish Vaidyanathan Shankar on 12th December, 2025 has affirmed that New Delhi was the arbitral seat and...

S. 482 CrPC | High Court Cannot Quash Cheque Bounce Cases By Conducting Pre-Trial Enquiry Into Debt Or Liability : Supreme Court

The Supreme Court on Friday (December 19) held that it is impermissible for the High Courts to quash cheque dishonour proceedings by undertaking a pre-trial enquiry into disputed facts, particularly when a statutory presumption under Section 139 of the Negotiable Instruments Act, 1881 operates in favour of the complainant. “we are of the considered view that the High Court committed an error...

Calcutta High Court Quashes Tender Blacklisting Of Pharma Firm; Says Show-Cause Notice Must Clearly Propose Debarment Action

“When it comes to blacklisting, the requirement becomes all the more imperative… it is the harshest possible action,” the Calcutta High Court stressed while setting aside a three-year debarment and forfeiture of performance bank guarantee imposed on Helax Healthcare Pvt Ltd for alleged supply of non-standard Telmisartan tablets.Justice Krishna Rao held that the September 26,...