Arbitration

Arbitration Clause In Expired Lease Cannot Be Invoked To Execute Fresh Lease: Calcutta High Court

The Calcutta High Court has recently held that an arbitration agreement in an expired lease deed cannot be automatically extended to govern disputes relating to the execution of a fresh lease, even if the proposed lease is claimed to arise from prior correspondence between the parties. Justice Aniruddha Roy in an order dated 23 December, 2025, dismissed an application filed by HDFC...

Business Law Daily Round-Up: December 23, 2025

TAX CESTAT Mumbai Grants Major Relief To Capgemini; Holds IT/ITES Services Eligible For CENVAT CreditGSTAT Directs Builder To Return Over ₹20 Lakhs Benefit To Diya Greencity Homebuyers With InterestSecurity & Scavenging Services To Govt Hospitals Qualify As "Pure Services", Exempt From GST: West Bengal AARGST | Delhi High Court Grants Interim Relief To ICICI Bank Over Demand Of...

Past Employment With Party Does Not Make Arbitrator Ineligible: J&K&L High Court Reaffirms

The Jammu and Kashmir and Ladakh High Court on Monday reiterated that an arbitrator does not become ineligible merely because he was employed by one of the parties in the past. The court held that past government service, by itself, does not indicate bias under the Arbitration and Conciliation Act unless it is shown that the arbitrator has a continuing business relationship or had advised...

Business Law Daily Round-Up: December 22, 2025

TAX Service Tax | Pairing & Testing Smart-Cards For Set-Top-Boxes Qualifies As Job Work: Bombay High Court Allows CreditCustoms Act | Penalty Cannot Be Sustained Solely On S. 108 Statements Without Compliance Of S. 138B: Kerala High CourtLevy Of Service Tax On 'Access To Amusement Facilities' Unconstitutional: Kerala High CourtNon-Filing Of ITR By Creditor Not Proof For Lack...

Bombay High Court Rejects Mumbai Metro's Arbitration Request Application, Rules Settlement Agreement Supersedes Original Contract

The Bombay High Court recently rejected the Mumbai Metro One Private Limited's (MMOPL) request to have its dispute with Hindustan Construction Company (HCC) resolved by way of arbitration. The Court deciding that the arbitration clause in the original contract no longer applies to new issues emerging from the settlement, ruled that once a "full and final" settlement agreement is executed,...

Res Judicata Not Attracted Where Issue Was Not Framed In Earlier Proceedings: Bombay High Court Partially Modifies Arbitral Award

The Bombay High Court has held that res judicata does not apply where the issue in earlier proceedings was neither framed nor directly adjudicated and that the court exercising jurisdiction under section 34 of the Arbitration and Conciliation Act, 1996 (Arbitration Act) can modify an award by reducing the rate of interest where bad part of an award is severable from the good...

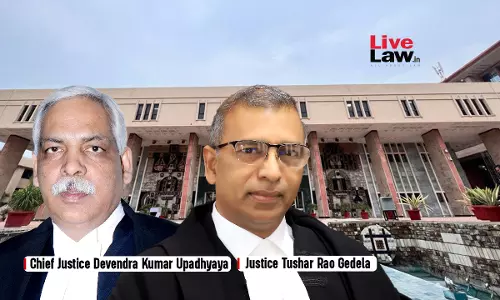

Non-Obstante Clause U/S 13(2) Commercial Courts Act Prevails Over S.10 Delhi HC Act: Delhi High Court Dismisses Arbitral Appeals

The Delhi High Court Bench of Chief Justice Devendra Kumar Upadhyaya and Justice Tushar Rao Gedela while dismissing an appeal under Section 10, Delhi High Court Act (“DHC Act”) and Section 13(2), Commercial Courts Act (“CC Act”) observed that the expression “any other law for the time being in force” used in Section 13(2), CC Act encompasses in its fold the provisions of...

Fresh Arbitration Notice is Mandatory For Second Round Of Arbitration After Earlier Award Is Set Aside: Kerala High Court

The Kerala High Court has held that a fresh arbitration notice under section 21 of the Arbitration and Conciliation Act, 1996 (Arbitration Act) is mandatory for initiating a second round of arbitral proceedings after an earlier arbitral award has been set aside even when the award was declared as a nullity due to invalid appointment of the arbitrator. Justice S. Manu while...

Bombay High Court Quashes ₹173.72 Cr Arbitral Award Against Thermax, Holds Arbitrator's Findings To Be Based On Lack Of Evidence

The Bombay High Court has recently set aside an arbitral award that mandated engineering giant Thermax Limited to pay ₹173 crore in favor of Rashtriya Chemicals & Fertilizers Ltd. (RCF). The award primarily directed payments towards the additional costs RCF incurred for power due to failure of gas turbine generators. Considering a challenge under Section 34 of the Arbitration...

Municipal Corporations Not Entitled To Unconditional Stay U/S 36 A&C Act; Treated At Par With Private Parties: P&H High Court

The Punjab and Haryana High Court Bench of Chief Justice Sheel Nagu and Justice Sanjiv Berry has observed that being a statutory body does not entitle a party to claim unconditional grant of stay under Section 36, Arbitration and Conciliation Act (“ACA”) as a matter of right. And if a conditional stay is granted, a statutory body is to be treated at par with a private...

Mozambique Coal Mine Dispute: Delhi High Court Refuses To Stay $10.53 Million Bank Guarantee Encashment

The Delhi High Court recently dismissed a petition filed by Black Gold Resources Private Limitada to prevent the termination of its coal mining contract in Mozambique as well as the invocation of a $10.5 million Performance Bank Guarantee (PBG) by International Coal Ventures Pvt. Ltd. and Minas De Benga Limitada. While withdrawing an earlier interim stay, Justice Jasmeet Singh on December...

Business Law Daily Round-Up: December 20, 2025

TaxCan GST Be Levied On Medicines Supplied During In-Patient Treatment? Delhi High Court To ExamineIncome Tax Act | S.153C Trigger Starts On Handing-Over Date, Not Search Date: Delhi High Court ITC Cannot Be Denied To Purchasing Dealer Solely Due To Retrospective Cancellation Of Supplier's GST Registration: Calcutta High Court GST Not Leviable On Interest/Penalty Charged By Chit Fund...