High Courts

MP High Court Launches Special Training Programme For SC/ST Civil Judge Aspirants

The Madhya Pradesh High Court has initiated a specialized “Capacity Building Programme” for aspirants and Advocates (belonging to Scheduled Castes, Scheduled Tribes and others) who are preparing for the Civil Judge, Junior Division (Entry Level) Examination. The programme, inaugurated by the Chief Justice Sanjeev Sachdeva, emphasized its commitment to provide guidance and structured...

'Affront To Personal Liberty', NBW Can't Be Issued Before Scheduled Date Of Appearance Of Accused U/S 35(3) BNSS: Orissa High Court

The Orissa High Court has held that non-bailable warrant of arrest (NBW) cannot be issued against an accused before the scheduled date of appearance, upon issuance of notice under Section 35(3) of the Bharatiya Nagarik Suraksha Sanhita (BNSS).Terming such dereliction as an “affront to personal liberty” of the accused, the Single Bench of Justice Gourishankar Satapathy held –“…it...

Tata Power Moves Delhi High Court Against DERC Rules Forcing DISCOMs To Finance Govt Works Without Interest

The Delhi High Court today issued notice on a petition filed by Tata Power Delhi Distribution Ltd. challenging Delhi government's recent amendments to the Delhi Electricity Commission Regulations inasmuch as it compels distribution companies to finance Government infrastructure works, without allowing recovery of interest, time value of money, or compensatory interest for delayed...

Delhi High Court Judge Recuses From Hearing Rani Kapur's Plea Against Priya Kapur, Karisma Kapoor's Children Over 'Fraudulent' Family Trust

The Delhi High Court will hear on Thursday (January 29), a suit moved by late industrialist Sunjay Kapur's mother, Rani Kapur against her daughter-in-law Priya Kapur and actress Karisma Kapoor's children alleging that they orchestrated a “fraudulent family trust” to unlawfully strip her of her entire estate.The matter was listed on Wednesday (January 28) before Justice Vikas Mahajan,...

'Invasion Of Privacy': MP High Court Rejects Husband's Plea For Wife's Virginity Test

The Madhya Pradesh High Court has recently dismissed a husband's petition seeking a virginity or two-finger test on the wife because she refused to enter into a physical relationship with him.The bench of Justice Vivek Jain observed that a virginity test could not be ordered as it violates the privacy of an individual and that the husband could produce other evidence to show that the wife...

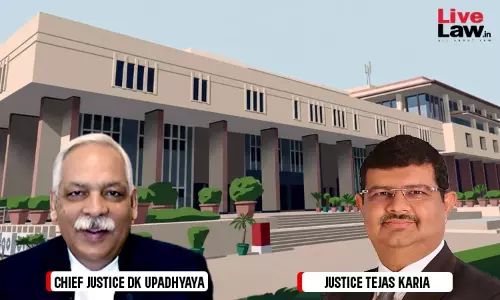

Delhi High Court Flags Need For Emergency Healthcare Facilities In District Courts, Directs Petitioner To Administrative Side

The Delhi High Court on Wednesday (January 28) disposed of a PIL seeking adequate medical facilities in city's District Court Complexes, to provide emergency healthcare to stakeholders including lawyers, litigants and security personnel.A division bench of Chief Justice DK Upadhyaya and Justice Tejas Karia emphasized on the importance of issue raised and asked the Petitioner to approach the...

'Very Stressing': Delhi High Court Takes Suo Moto Cognizance Of Alleged Drug Syndicate In Okhla Industrial Area

"This is very stressing", the Delhi High Court orally remarked today while taking suo moto cognizance of alleged drug syndicate running in city's Okhla Industrial area.A division bench of Chief Justice DK Upadhyaya and Justice Tejas Karia has appointed an amicus curiae to visit the area and conduct an inquiry, following which Police action will be ordered.The development comes while the Court...

Delhi High Court Issues Notice On Plea Against Bar On Adoption Of Unused Embryo By Infertile Couples

The Delhi High Court on Wednesday (January 28) issued notice on a PIL challenging "blanket prohibition" on altruistic donation of a couple's unused frozen embryos, for adoption by another infertile couple.A division bench of Chief Justice DK Upadhyaya and Justice Tejas Karia orally observed that the Petitioner seeks to expand the scope of Section 28 of the Assisted Reproductive...

Delhi High Court Issues Notice On Congress Leader Karti Chidambaram's Plea Against Charges In Chinese Visa Scam Case

The Delhi High Court on Wednesday (January 28) issued notice on a plea filed by Congress MP Karti P Chindambaram challenging a trial court order framing charges against him in connection with the Chinese visa scam case being probed by the Central Bureau of Investigation. After hearing the matter for some time Justice Manoj Jain in his order dictated:"The petitioner assails order dated...

'Barbarity Dripping From Every Ounce': MP High Court Confirms Death Penalty For Rape, Murder Of 5-Yr-Old

The Madhya Pradesh High Court has affirmed the order of a Special Court convicting a man and sentencing him to death penalty for raping and murdering a five-year-old girl. The division bench of Justice Vivek Agarwal and Justice Ramkumar Choubey observed that the accused used a knife inside the victim's vagina to enlarge it, making it easier for penetration on an infant girl. Further, the...

'Direct Nexus With Safety': Delhi High Court Seeks DGCA Stand On Plea To Implement Pilot Resting Norms

The Delhi High Court on Wednesday (January 28) sought stand of the Directorate General of Civil Aviation (DGCA) on a plea challenging its decision to keep in abeyance the regulations on Flight Duty Time Limitations, which prescribe minimum resting time for pilots and flight crew members to ensure passenger safety.The plea states that the norms are meant to strengthen "fatigue management"...

Procedural Compliance U/S 133 CrPC Mandatory; Well-Intentioned Orders Can't Survive Procedural Lapses: J&K&L High Court

The Jammu & Kashmir and Ladakh High Court has dismissed a petition challenging the remand of proceedings under Section 133 CrPC to the Sub Divisional Magistrate (SDM) for fresh consideration, holding that procedural compliance under Chapter X CrPC is mandatory and cannot be bypassed even for a "well-meaning" order.A bench of Justice Rahul Bharti held that if the provisions of Chapter X of...