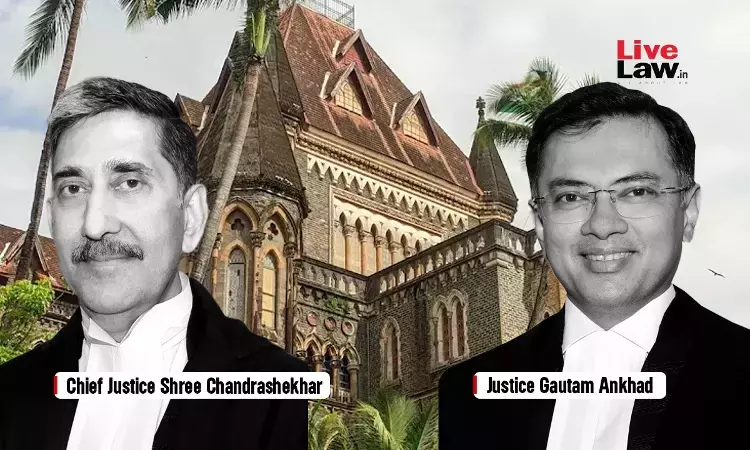

Bombay High Court

Reassessment Notice To Non-Existent Firm Invalid: Bombay High Court Reiterates

The Bombay High Court has reiterated that proceedings initiated against a non-existent entity are invalid in law. A Division Bench of Justices B.P. Colabawalla and Amit S. Jamsandekar set aside a reassessment notice and a consequential assessment order issued under the Income Tax Act against a partnership firm that had merged into a private limited company years earlier. The case concerned...

Further Investigation U/S 173(8) CrPC After Framing Of Charge Cannot Be Ordered Routinely; Must Be Backed By Reasons: Bombay High Court

The Bombay High Court has held that though an application for further investigation under Section 173(8) of the Code of Criminal Procedure may be maintainable even after framing of charge, such power cannot be exercised mechanically or routinely, and must be supported by strong and justifiable reasons demonstrating serious lapses in investigation. The Court observed that a fair...

Income From Telecom Tower Doesn't Turn Housing Society Into 'Industry', Upkeep Staff Not Entitled To Gratuity: Bombay High Court

Mere installation of telecommunication antennas on the terrace and employing workers to manage the affairs of the society, does not make a cooperative housing society an 'industry' or an 'establishment' under the Industrial Disputes Act (ID Act) or the Maharashtra Shops and Establishments (Regulation of Employment and Conditions of Service) Act, respectively, held the Bombay High Court on...

MPCB Cannot Impose Territorial Curbs On Authorised Hazardous Waste Facility Through Circulars; Violates Article 19(1)(g): Bombay High Court

The Bombay High Court has held that the Maharashtra Pollution Control Board (MPCB) has no authority under the Hazardous and Other Wastes (Management and Transboundary Movement) Rules, 2016, to impose territorial restrictions on the business operations of an authorised pre-processing facility. The Court held that the amended circular dated 15 February 2024 and the consequential insertion of...

Setback For Sharad Pawar's Grandson, Bombay High Court Stays Elections Of Maharashtra Cricket Association Amid 'Nepotism' Allegations

Amid the political 'slugfest' between the Bharatiya Janata Party (BJP) and the Nationalist Congress Party (Sharad Pawar Faction) (NCP-SP), Bombay High Court on Monday (January 5) stayed the proposed elections of the Maharashtra Cricket Association (MCA), which were scheduled to take place on January 6 till further orders. A division bench of Chief Justice Shree Chandrashekhar and Justice...

Father-In-Law Refusing To Intervene In Husband's Affair, Advising Wife To 'Tolerate' Domestic Violence Not Cruelty U/S 498A IPC: Bombay HC

A woman's father-in-law refusing to listen to her complaint about her husband's 'extra-marital affair' and her brother-in-law (husband's brother) asking her to 'tolerate' her husband's beating would not amount to cruelty under section 498A of the Indian Penal Code (IPC), the Bombay High Court held recently.A division bench of Justices Bharati Dangre and Shyam Chandak delivered the ruling...

Bombay High Court Sets Aside Arbitral Award Passed With “Undue Haste” After Four-Year Delay

The Bombay High Court has set aside an arbitral award, holding that it was passed in undue haste after nearly four years of inaction and without giving the parties any opportunity of hearing.A Single Bench of Justice Sandeep V Marne found that the arbitrator acted with undue haste and in clear breach of natural justice. Rejecting the explanation offered for the long delay, the Court...

Bombay High Court Sets Aside Arbitral Awards Holding Sharekhan Liable For Investor Losses In F&O Trades

The Bombay High Court recently ruled that mere violation of SEBI's trade confirmation circular does not automatically make a broker liable for market losses, and it set aside arbitral awards that directed stockbroker Sharekhan Limited to reimburse investors for losses sustained in Futures and Options (F&O) trading. The Single Bench on 24th December, 2025, decided that investors who...

Dalmia Cement Case: Bombay High Court Holds Two-Year Extension Under Mineral Auction Rules Is Mandatory

The Bombay High Court has held that once the State Government is satisfied that the delay in execution of a mining lease is for reasons beyond the control of the preferred bidder, the extension contemplated under the second proviso to Rule 10(6) of the Mineral (Auction) Rules, 2015 must be for the full period of two years and cannot be curtailed. The Court observed that the provision does...

Bombay High Court Bars Restaurant Chains Operating 94 Outlets From Playing PPL Music Without License

The Bombay High Court has, in an interim order, restrained two restaurant operators running around 94 outlets from publicly playing music from Phonographic Performance Limited's repertoire without a license after finding a prima facie case of copyright infringement. Justice Sharmila U. Deshmukh, in an order pronounced on December 24, 2025, held that continued unauthorised use would cause...

Bombay High Court Rejects Interim Injunction Sought by Sun Pharma Against “RACIRAFT” Rival “EsiRaft”

The Bombay High Court, in an interim order, has refused to restrain Gujarat based-Meghmani Lifesciences Limited from using the trademark “EsiRaft” for its pharmaceutical product used to treat heartburn and indigestion. The court held that the mark is not deceptively similar to Sun Pharmaceutical Industries Limited's “RACIRAFT.”A single bench of Justice Sharmila U Deshmukh passed the...

Arbitral Award Holder Must Return Amount Withdrawn From Court After Insolvency Resolution: Bombay High Court

The Bombay High Court has held that where an arbitral award passed against a company is under challenge, and the company later successfully comes out of insolvency, the award holder cannot retain money withdrawn from court deposits if the claim itself is wiped out under an approved resolution plan. The court said such amounts must be returned, as the award itself no longer survives....