Delhi High Court

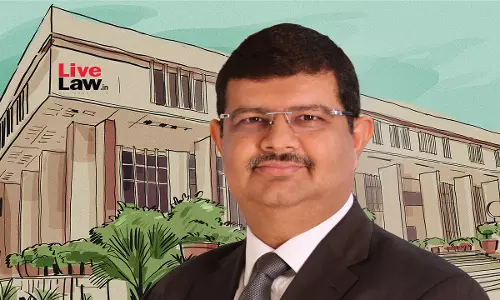

Delhi High Court Cancels “ACTIVEPUSHPA” Trademark For Similarity With Ayurvedic Brand “HEMPUSHPA”

The Delhi High Court has ordered the removal of the trademark “ACTIVEPUSHPA” from the Trade Marks Register, holding that the mark is deceptively similar to “HEMPUSHPA,” a decades-old ayurvedic tonic for women's health, and is likely to confuse consumers. A single-judge Bench of Justice Tejas Karia, in an order dated December 24, 2025, allowed a rectification plea filed by...

Husband's Foreign Income Can't Be Mechanically Converted Into Indian Currency For Maintenance To Wife: Delhi High Court

The Delhi High Court has recently observed that a husband's foreign income cannot be mechanically converted into Indian currency for granting maintenance to wife.“Mere earning in foreign currency does not, by itself, entitle the wife to claim maintenance by mechanically converting the husband's foreign income into Indian currency and applying the formulae evolved by Indian courts without...

Delhi High Court Upholds Order Rejecting Ericsson's Data Security Invention Patent

The Delhi High Court has upheld a 2019 order of the Patent Office rejecting a patent application filed by Swedish telecom major Telefonaktiebolaget LM Ericsson for a data security invention. The court held that the claimed method did not involve an inventive step and was obvious in light of existing technology. Dismissing Ericsson's appeal, the court said there was no reason to interfere...

Delhi High Court Passes John Doe Order Protecting Personality Rights Of Andhra Pradesh Deputy CM Pawan Kalyan

The Delhi High Court has passed a john doe interim order protecting the personality rights of Deputy Chief Minister of Andhra Pradesh Pawan Kalyan.Justice Manmeet Pritam Singh Arora said that the defendants were using Kalyan's name, likeness, voice, and image for selling merchandise for commercial gains, without his consent, either directly or through e-commerce platforms.The Court said that...

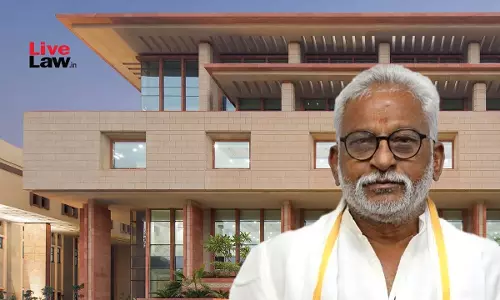

Delhi High Court Refuses Ex-Parte Injunction To YSRCP Leader In Defamation Case Against Tirupati Laddu Adulteration Case Reporting

The Delhi High Court recently refused interim relief to YSRCP leader Y. V. Subba Reddy, in his defamation suit filed against media reporting of Tirupati laddu adulteration case.Justice Amit Bansal was not inclined to grant an ex-parte ad interim injunction in favour of Reddy and against the defendants qua the impugned publications or articles. The Court said that prima facie, it would only...

Delhi High Court Appoints Wife As Legal Guardian Of Husband In Comatose State, Exercises Parens Patriae Jurisdiction

The Delhi High Court has appointed a wife as legal guardian of her husband who has been in a vegetative or comatose state after suffering from an “Intracranial Haemorrhage” in February, 2025. Justice Sachin Datta invoked the parens patriae jurisdiction for appointing legal heir or spouse as the legal guardian.The Court directed that the wife, Professor Alka Acharya, shall have the right...

Brevity Of Reasons In Order Refusing Sanction To Prosecute Public Servant Not Ground To Invoke Writ Jurisdiction: Delhi High Court

The Delhi High Court has held that mere brevity of reasons in an order refusing sanction to prosecute public servants is not, by itself, a ground to invoke writ jurisdiction, so long as the record demonstrates due application of mind by the competent authority.Justice Amit Mahajan observed,“Mere brevity of reasons in the impugned order, by itself, cannot be a ground to invoke writ...

Delhi High Court Rejects Zydus Plea Against Helsinn's Nausea Medication Patent

The Delhi High Court has refused to interfere with the grant of a pharmaceutical patent for a nausea medication dismissing a challenge by Zydus Healthcare Ltd. against Swiss drugmaker Helsinn Healthcare SA The court held that the Patent Office committed no jurisdictional error and did not violate principles of natural justice while granting the patent. In a judgment dated December 24,...

Delhi High Court Criticizes Police For Inserting 'Haath Mara' Expression In Every Assault FIR Lodged By Women

Calling it unfortunate, the Delhi High Court has recently observed that every FIR alleging assault or outraging modesty of a woman mentions the expression “haath mara” which is not endorsed by the complainant. Justice Neena Bansal Krishna said that the situation is “gross misuse of law” and requires introspection at the level of all police stations. “It is unfortunate that in every...

Delhi High Court Bars Use Of “IGBC” Name Over Similarity With US Green Building Council Mark

The Delhi High Court has permanently restrained Mumbai-based Deming Certification Services Private Limited from using the marks “International Green Building Council,” “IGBC,” or any deceptively similar to the mark of U. S. Green Building Council (USGBC). The court held that the use infringed the registered trademarks of the USGBC, a non-profit organisation that promotes...

Transfer Pricing | Comparables With Non-Export Operations Can't Be Benchmarked Against Export-Only Assessee: Delhi High Court

The Delhi High Court has made it clear that companies engaged in activities beyond export services cannot be treated as functionally comparable to an assessee providing export-only services.A Division Bench of Justices V. Kameswar Rao and Vinod Kumar thus upheld exclusion of such entities for the purpose of transfer pricing analysis qua an assessee engaged in providing investment...

Employment Agreement Is Valid Proof of Right: Delhi High Court Sets Aside Patent Rejection After Inventor's Death

The Delhi High Court has set aside a Patent Office order that refused a patent application filed by Nippon Steel Corporation for a “high-strength steel sheet and its manufacturing method.” The court held that the Patent Office wrongly rejected the application on the ground that Nippon Steel had failed to establish “proof of right.” It also found fault with the Patent Office's view...