News Updates

Centre Notifies Appointment of Justice SS Shinde As Chief Justice of Rajasthan High Court

The Central Government has notified the appointment of Justice Shinde Shambhaji Shivaji as the Chief Justice of the Rajasthan High Court. He is presently serving as the Judge of Bombay High Court.He has less than two months of tenure left as a High Court judge.Justice Shinde was recently recommended by the Supreme Court collegium for elevation as a Chief Justice.Justice Shinde has presided...

Mere Presence Of The Person In The Brothel During Raid Does Not Entail Penal Consequences: Madras High Court

While quashing criminal proceedings against a person who was arrayed as an accused during a raid of a Massage centre which was allegedly a brothel, the Madras High Court bench of Justice N Sathish Kumar observed that merely because the petitioner was in the place, he could not be fastened with penal consequences. In the present case, the allegation against the petitioner was that he...

Arbitration Cases Weekly Round-Up: 12 June To 18 June, 2022

Bombay High Court: Court Can Pass An Order Of Interim Measures Under Section 9Of The A&C Act Against A Third Party: Reiterates Bombay High Court Case Title: Choice Developers versus Pantnagar Pearl CHS Ltd. & Ors. The Bombay High Court has reiterated that the Court is free to pass an order under Section 9 of the Arbitration and Conciliation Act, 1996 (A&C Act) to...

Delhi High Court Weekly Round Up: June 13 To June 19, 2022

NOMINAL INDEXCitations 2022 LiveLaw (Del) 566 TO 2022 LiveLaw (Del) 577Case Title: Mukish v. State 2022 LiveLaw (Del) 566Title: BRINDA KARAT AND ANR. v. STATE OF NCT OF DELHI AND ANR. 2022 LiveLaw (Del) 567Case Title: Prem Brothers Infrastructure LLP. versus National Faceless Assessment Centre & Anr. 2022 LiveLaw (Del) 568Case Title: SANTOSH KUMAR v. UNION OF INDIA & ANR 2022...

Tax Cases Weekly Round-Up: 12 June To 18 June, 2022

Delhi High CourtDelhi High Court Quashes Assessment Order For Not Giving Opportunity To File Objection To SCN Case Title: Jindal Exports and Imports Private Limited Vs DCIT The Delhi High Court bench of Justice Manmohan and Justice Dinesh Kumar Sharma has quashed the assessment order as the assessee was not given an opportunity to file an objection to the show...

Doctors Left Sponge In The Abdomen During LSCS Operation, Liable For Medical Negligence; NCDRC

The bench of National Commission comprising Justice R.K. Agrawal, President and Dr. S.M. Kantikar, Member has observed that, no amount of money can turn back the time and reverse the harm already done, but receiving compensation for unnecessary surgery or surgical errors can at least help the patient to overcome some of the challenges that lie ahead. Commission stated that, mistakes...

Application For Enforcement Of Arbitral Award Would Lie Only Before The Court Where Application Under Section 9 And/ Or Section 34 Has Been Filed : Reiterates Telangana High Court

The Telangana High Court has reiterated that in view of Section 42 of the Arbitration and Conciliation Act, 1996 (A&C Act), only the Court where an application under Section 9 and/or Section 34 has been filed would have the jurisdiction to entertain an application for enforcement of the arbitral award. The Bench, consisting of Justices P. Naveen Rao and Sambasivarao Naidu, held...

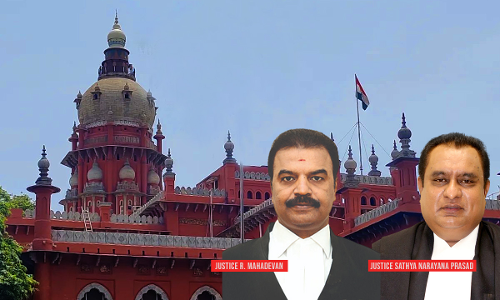

Period Of Limitation Under S.153 Of Income Tax Act Applies To Remand Proceedings : Madras HC

The Madras High Court recently observed that the period of limitation under the Sections 153 (2A) or 153 (3) was applicable even for remad proceedings before the Assessing Officer, Transfer Pricing Officer or the Dispute Resolution Panel. The entire proceedings had to be conducted within a period of 9 months as contemplated under Section 144C (12) of the Income Tax Act. The bench of Justice...

Prophet Remark Row : Srinagar Court Orders Police Inquiry In Complaint Against Nupur Sharma, Naveen Jindal, Navika Kumar

The court of City Judge Srinagar today directed the Senior Superintendent of Police Srinagar to conduct an inquiry under Section 202 of the Code of Criminal Procedure for ascertaining if there exist sufficient grounds to proceed in the complaint filed before it against Nupur Sharma and others, for comments on Prophet Muhammad. The court has further passed the directions to complete...

Order Terminating The Arbitration Not Challenged; Can't File Section 8 Application Later: Karnataka High Court

The High Court of Karnataka has held that a subsequent Section 8 application would be non-maintainable when the order of the arbitrator accepting objection to its jurisdiction was not challenged. The Division Bench of Justice Alok Aradhe and Justice J.M. Khazi held that once the order of the arbitrator terminating the arbitral proceedings has attained finality, it would not be open for...

No Deliberate Mis-Declaration In Bill of Entry To Short Pay Custom Duty: CESTAT Quashes Confiscation, Penalty

The Delhi Customs, Excise and Service Tax Appellate Tribunal (CESTAT) has quashed the confiscation and the penalty under Section 112(a)(ii) and 114AA of the Customs Act as there was no deliberate mis-declaration in the bill of entry to short pay custom duty. The bench of Anil Choudhary (Judicial Member Judicial) has quashed the confiscation and penalty on the grounds that the appellant...

Covid-19: Karnataka High Court Issues Notice To Centre On Senior Citizens' Plea Seeking Administration Of 'Covovax' Vaccine To Adults

The Karnataka High Court has issued notice to the Central government and other respondents on a petition filed by a senior citizen Arun Kumar Agarwal seeking directions to permit administration of the Covovax vaccine, manufactured by M/s. Serum Institute of India Pvt. Ltd to persons above the age of 18 years. A single judge bench of Justice S G Pandit issued the notice. The plea says...