Supreme court

Refund For Unutilised Input Tax Credit Can't Be Claimed On Account Of Input Services: Supreme Court Upholds Validity Of Section 54(3) CGST Act

The Supreme Court held that Section 54(3) of the Central Goods and Services Act excludes unutilised input tax credit that accumulated on account of input services.When there is neither a constitutional guarantee nor a statutory entitlement to refund, the submission that goods and services must necessarily be treated at par on a matter of a refund of unutilized ITC cannot be accepted, the...

Breaking: Supreme Court Reserves Interim Order On Pegasus Cases After Centre Expressed Unwillingness To File Affidavit On Spyware Use

The Supreme Court on Monday reserved interim orders on a batch of petitions seeking investigation into the alleged illegal use of Pegasus spyware to snoop civilians, journalists, etc. The development comes as the Centre has expressed unwillingness to file an affidavit in the matter, citing concerns over national security. "We thought the Government will file a counter-affidavit and...

Pegasus- Supreme Court Hearing-LIVE UPDATES

Supreme Court bench headed by Chief Justice NV Ramana will continue the hearing on petitions seeking SIT probe in the pegasus snoop-gate row.Supreme Court bench on August 17 issued notice before admission to the Central Government in a batch of petitions seeking probe into the Pegasus snooping controversy.The Central Government filed an affidavit before the Supreme Court stating that it...

Requirement To Frame Substantial Question Of Law In Second Appeal Not A Mere Formality, But Meant To Be Adhered To: Supreme Court

The Supreme Court observed that the requirement to frame substantial question of law in a second appeal is not a mere formality, but is meant to be adhered to.The limitation on the exercise of power by the High Court in the Second Appeal interfering with the judgment of the First Appellate Court is premised on high public policy, the bench of Justices KM Joseph and S. Ravindra Bhat...

Supreme Court Weekly Round Up, September 6 To September 12, 2021

JUDGMENTS THIS WEEK1. Income Tax Act - Disallowance Under Section 14A Can't Be Made Just Because Assessee Has Not Maintained Separate Accounts For Expenditures Incurred For Tax-Free Income : Supreme CourtCase: South Indian Bank Ltd. Vs. Commissioner of Income Tax ; CA 9606 OF 2011Citation: LL 2021 SC 435Giving tax relief to a group of scheduled banks, the Supreme Court has observed that...

Swami Vivekananda Advocated Secularism And Tolerance, Analysed Dangers Posed By Sectarian Conflicts: CJI NV Ramana

Chief Justice of India NV Ramana on Sunday reflected upon the acute relevance of the teachings of Swami Vivekananda. He was addressing an event as the Chief Guest to mark the 128th anniversary of the historic Chicago Address of Swami Vivekananda and the 22nd Foundation Day of Vivekananda Institute of Human Excellence, Hyderabad. "Swami Vivekananda, in his address, propagated the idea of...

Plus One Exams Can't Be Held Online; Many Students Lack Computers Or Mobile Phones : Kerala Govt Tells Supreme Court

Justifying the decision to hold Plus One (Class XI) exams in offline mode, the Kerala Government has told the Supreme Court that conducting the examinations in online mode will cause prejudice to a large number of students, especially those belonging to the lower strata.The affidavit filed by APM Muhammed Hanish, Principal Secretary to the General Education Department, stated that the the...

Centre Issues Guidelines For COVID Death Certificates Following Supreme Court's Directions

The Government of India has told the Supreme Court that it has framed guidelines to simplify the process of the issuance of COVID-19 death certificates in compliance with the directions in the judgment passed on June 30.A compliance affidavit filed before the Supreme Court on September 11 stated that the Union Ministry of Health and Family Welfare and the Indian Council for Medical Research...

Income Tax Act - Disallowance Under Section 14A Can't Be Made Just Because Assessee Has Not Maintained Separate Accounts For Expenditures Incurred For Tax-Free Income : Supreme Court

Giving tax relief to a group of scheduled banks, the Supreme Court has observed that the assessing officer cannot make disallowance of deduction under Section 14A of the Income Tax Act merely because the assessee has not maintained separate accounts for expenses incurred in earning tax-free income.In the case South Indian Bank Ltd v. Commissioner of Income Tax, the Court observed...

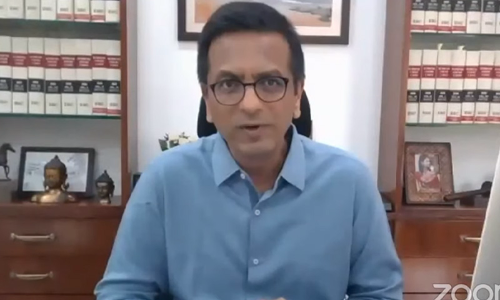

Paperless Court Not Possible Without A Change In The Mindset Of Bar And The Bench: Justice DY Chandrachud

Supreme Court Judge Justice DY Chandrachud on Saturday said that none of the efforts of the e-committee of the Supreme Court or the High Courts could be possible without a change in the mindset of the bar and the bench."I believe a change in the mindset must be brought about both among lawyers and amongst judges. When I started working on a paperless court about a year and a half ago, I was...

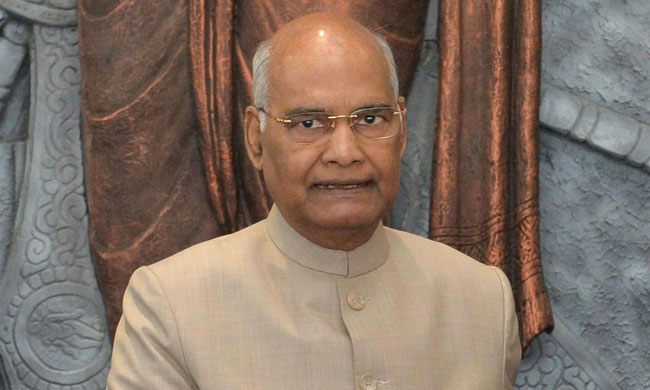

Women Have A Greater Inclination Towards Justice : President Bats For More Women Representation In Judiciary

President Ram Nath Kovind on Saturday emphasised upon the need to increase representation of women in the judicial system in order to achieve a just and equitable society. The President was speaking at an event to lay the foundation stones of the new National Law University at Prayagraj, Allahabad and the new building complex of the Allahabad High Court. "A society full of justice will...