Trending

NLU Odisha Announces Alternate Movie Ending Competition On Andhadhun; Entries Open Till March 7

The Centre for Film Studies at National Law University Odisha has invited students from recognised higher education institutions across India to participate in its Alternate Movie Ending Competition.Participants are required to reimagine and write an alternate ending to the 2018 film Andhadhun, directed by Sriram Raghavan. Entries must clearly state the point where the narrative diverges from the original storyline while remaining consistent with the film's characters, themes, and...

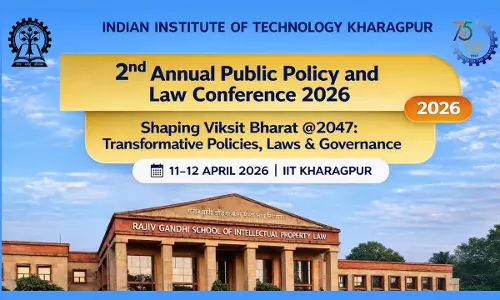

IIT Kharagpur Announces Annual Public Policy Conference; Abstract Submission Closes On Feb 20

The Centre of Excellence in Public Policy Law and Governance at IIT Kharagpur will host the 2nd Annual Public Policy and Law Conference 2026 on April 11–12, 2026, at IIT Kharagpur.Titled “Shaping Viksit Bharat @2047: Transformative Policies, Laws and Governance,” the conference will examine the role of governance reforms in advancing India's inclusive, sustainable, and equitable development by the centenary of Independence.The conference will focus on the evolving relationship between public...

U.P. State Legal Services Authority Launches Nyaya Rath Mobile Legal Aid Vehicles Across 74 Districts

The Uttar Pradesh State Legal Services Authority (UPSLSA) organized a programme on 14 February 2026 at 3:15 PM at the Chief Justice Portico, High Court, Lucknow Bench, to mark the Flag-Off Ceremony of Multi-Utility Vehicles for the 74 District Legal Services Authorities of Uttar Pradesh, along with the launch of the State Mediation Helpline.The programme was inaugurated by Justice Vikram Nath, Judge, Supreme Court of India and Executive Chairman, National Legal Services Authority (NALSA), New...

Law Without Remedy: Unpaid Salaries In India's Online Work Economy

Salary theft in India's IT and online operational sector is no longer an exception. It has become a business model quiet, procedural, and legally sanitised.In India's fast-growing IT and online services ecosystem, non-payment of salary has become a disturbingly common experience. Employees are not just terminated; they are financially strangled. Performance bonuses are withheld without explanation, salaries for the last three to six months are stopped, and the employee is pushed into silence...

Madras High Court Monthly Digest: January 2026 [Citation 1 to 51]

Citations: 2026 LiveLaw (Mad) 1 To 2026 LiveLaw (Mad) 51 NOMINAL INDEX Neelima v. The Additional Chief Secretary and Others, 2026 LiveLaw (Mad) 1 C. Aryama Sundaram v. The Commissioner Of Income Tax, Chennai, 2026 LiveLaw (Mad) 2 Siva.Kalaimani Ambalam v. The District Collector and Others, 2026 LiveLaw (Mad) 3 M. Manickamoorthy v. The District Collector and...

Public Exhibition Of Accused And Presumption Of Innocence

This is in the context of the public exhibition of accused persons, drawing from the Rajasthan High Court's recent order in Islam Khan & Ors. v. State of Rajasthan & Ors., S.B. Criminal Writ Petition No. 224/2026, decided on 20.01.2026 (Raj HC). It underscores the continued relevance of the presumption of innocence beyond the courtroom.An accused and a convict do not stand on the same footing. This distinction lies at the heart of criminal jurisprudence and underpins the necessity of the...

Supreme Court To Hear Pleas Seeking FIR Against Assam CM Himanta Biswa Sarma On Feb 16

The Supreme Court will hear on Monday (February 16) a batch of petitions seeking the lodging of a first information report and constitution of a Special Investigation Team(SIT) probe against Chief Minister of Assam, Himanta Biswa Sarma, for the offences relating to hate speech over his comments on 'Miya Muslims' and the 'point blank' video.A bench comprising Chief Justice Surya Kant and Justice Joymalya Bagchi will hear the matter.Recently, a video was posted on 'X' by the official handle...

Absconding Accused Not Entitled To Anticipatory Bail On Sole Ground Of Co-Accused' Acquittal : Supreme Court

The Supreme Court has held that the principle of parity cannot be invoked by an absconder who deliberately evades trial, to seek an anticipatory bail merely because a co-accused has been acquitted in a trial.The Court observed that "granting the relief of anticipatory bail to an absconding accused person sets a bad precedent and sends a message that the law-abiding co-accused persons who stood trial, were wrong to diligently attend the process of trial and further, incentivises people to evade...

Supreme Court Allows High Courts To Hear Consumer Appeals In States Where State Commission Not Formed

Supreme Court Invokes Article 142 To Ensure Functioning Of Consumer Commissions In Smaller States, Seeks SG's AssistanceInvoking its special powers under Article 142 of the Constitution, the Supreme Court recently empowered High Court Judges to hear consumer appeals in States where State Consumer Disputes Redressal Commissions. Many States found it “not viable” to constitute full-fledged State Consumer Disputes Redressal Commissions owing to low pendency.A Bench comprising the Chief Justice of...

Police Failure To Apply IPC Provisions Results In Acquittal Of Contractor for Stockpiling Decontrolled Cement : Supreme Court

The Supreme Court has set aside the conviction of a contractor accused of stockpiling cement meant for a public works project, holding that investigative lapses in failing to invoke IPC provisions against the contractor resulted in an untenable conviction under the Essential Commodities Act, since no statutory or regulatory control over cement existed at the relevant time. “…in the absence of any subsisting statutory order under Section 3 of the E.C. Act on the date of the alleged occurrence, a...

![Madras High Court Monthly Digest: January 2026 [Citation 1 to 51] Madras High Court Monthly Digest: January 2026 [Citation 1 to 51]](https://www.livelaw.in/h-upload/2022/02/01/500x300_408688-madras-high-court-monthly-digest.jpg)