Trending

Delhi High Court Sets Aside Patent Office Order Rejecting Emitec Emissions Dosing Device

The Delhi High Court has set aside a Patent Office order rejecting a patent application filed by Emitec Gesellschaft für Emissionstechnologie mbH, a Germany-based automotive emissions firm, for a reducing-agent dosing device that helps cut vehicle pollution.A single-judge bench of Justice Manmeet Pritam Singh Arora, in a judgment pronounced on December 24, 2025, held that the Patent...

Supreme Court To Pronounce Judgment On Bail Pleas Of Umar Khalid, Sharjeel, Gulfisha & Others In Delhi Riots Larger Conspiracy Case On Monday

The Supreme Court will pronounce judgment on the petitions filed by Umar Khalid, Sharjeel Imam, Gulfisha Fatima, Meera Haider, Shifa Ur Rehman, Mohd. Saleem Khan and Shadab Ahmed seeking bail in the Delhi riots larger conspiracy case on Monday.A bench comprising Justice Aravind Kumar and Justice NV Anjaria had concluded the hearing in the petitions filed against the September 2 judgment of...

NUSRL Ranchi To Host 2nd National Moot Court Competition On Consumer Protection Laws, 2026

The Chair on Consumer Research and Policy (CCRP), National University of Study and Research in Law (NUSRL), Ranchi, is organizing the 2nd National Moot Court Competition on Consumer Protection Laws, 2026, scheduled to be held from 27th February to 1st March, 2026.This National-level moot court competition aims to provide law students with an intellectually stimulating platform to engage with contemporary issues in Consumer Protection Laws. The competition focuses on enhancing participants'...

Dalmia Cement Case: Bombay High Court Holds Two-Year Extension Under Mineral Auction Rules Is Mandatory

The Bombay High Court has held that once the State Government is satisfied that the delay in execution of a mining lease is for reasons beyond the control of the preferred bidder, the extension contemplated under the second proviso to Rule 10(6) of the Mineral (Auction) Rules, 2015 must be for the full period of two years and cannot be curtailed. The Court observed that the provision does...

NCLT Chandigarh Approves Merger Of HPCL-Mittal Pipelines With HPCL-Mittal Energy

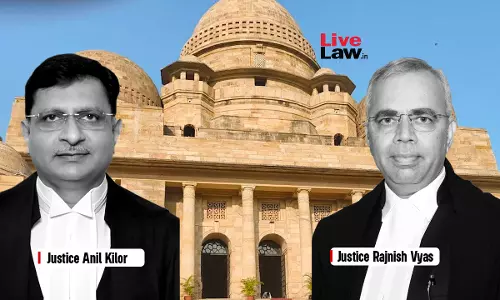

The National Company Law Tribunal (NCLT) at Chandigarh has approved the merger of HPCL-Mittal Pipelines Limited into HPCL-Mittal Energy Limited, a public–private joint venture between state-owned Hindustan Petroleum Corporation Limited and the Mittal Group. The order allows the pipeline company to be dissolved without winding up.The order was passed by a coram of Judicial Member...

NGT Seeks Further Progress Report From ICMR On Study Of Cancer Causing Chemicals Inside Vehicles

The National Green Tribunal (NGT) has taken on record a progress report filed by the Indian Council of Medical Research (ICMR) detailing steps undertaken towards conducting a scientific study to evaluate the health risks of flame-retardant exposure to drivers.Chairperson Prakash Shrivastava and Dr.A. Senthil Vel noted, "Dr. Sivaperumal, Scientist-E has submitted that the work is progressing...

Delhi High Court Family Law Digest 2025

Co-Accused Can Apply Separately For Compounding Of Offences Committed By Company Or HUF Under Income Tax Act: Delhi High CourtCase title: Sumit Bharana v. UoICitation: 2025 LiveLaw (Del) 4The Delhi High Court has held that co-accused are entitled to apply separately for compounding of offences committed by a Company or a Hindu Undivided Family under the Income Tax Act, 1961.A division bench...

Income Tax | Delay in Filing Form 10-B Due To COVID Cannot Deny S.11 Exemption: Andhra Pradesh High Court

The Andhra Pradesh High Court held that the exemption under Section 11 of the Income Tax Act cannot be denied merely on account of delay in filing the Form 10-B Audit Report when such delay was caused by the COVID-19 Pandemic. Justices Battu Devanand and A. Hari Haranadha Sarma observed that the assessee is a religious and charitable society and has to comply with the instructions...

Kerala High Court Directs Railway Claims Tribunal To Annex Details Of Evidence, Witnesses To All Its Orders

In an exercise of the supervisory jurisdiction under Article 227 of the Constitution, the Kerala High Court recently directed the Railway Claims Tribunal to follow Rules 181 of the Civil Rules of Practice so as to incorporate proper appendices to all its orders.Justice S. Manu observed that the Tribunal's judgments generally do not contain any attachment showing the witnesses examined...

Royalty Under Mining Lease Executed Before 1 April 2016 Not Taxable; CESTAT Delhi Remands Service Tax Demand Case

The New Delhi Principal Bench of the Customs, Excise and Service Tax Appellate Tribunal (CESTAT) has remanded a service tax demand raised on mining royalty paid to the State Government, holding that where the mining lease was executed prior to 1 April 2016, the applicability of service tax must be examined in light of the negative list regime under the Finance Act, 1994 . The...

[Bihar Excise Act] Patna High Court Slashes 90% Penalty On Insurance Declared Value Of Seized Motorcycle To 10% In Liquor Case

The Patna High Court has relaxed an excessive penalty of 90% of Insurance Declared Value (IDV) to 10% on a motorcycle seized in a liquor-related offence. A Division Bench comprising Justice Rajeev Ranjan Prasad and Justice Sourendra Pandey held that, considering the quantum of liquor (18 litres), applying Rule 12A of the Bihar Prohibition and Excise Rules, 2021, which prescribes 10%...

GST | ITC Not Available On Construction Of Warehouse Used For Storage Or Leasing: Gujarat AAR

The Gujarat Authority for Advance Ruling (AAR) has held that input tax credit (ITC) is not admissible on goods and services used for construction of a warehouse or shed, even when such warehouse is used for providing taxable storage and warehousing services or is leased out for business purposes. The ruling was delivered by the bench of CGST Member Vishal Malani and SGST...

![[Bihar Excise Act] Patna High Court Slashes 90% Penalty On Insurance Declared Value Of Seized Motorcycle To 10% In Liquor Case [Bihar Excise Act] Patna High Court Slashes 90% Penalty On Insurance Declared Value Of Seized Motorcycle To 10% In Liquor Case](https://www.livelaw.in/h-upload/images/500x300_patna-high-court.jpg)