Trending

Bombay High Court Quashes ₹1.26 Crore Arbitral Award Over Unilateral Appointment Of Arbitrator

The Bombay High Court recently set aside a ₹1.26 crore arbitral award made in favor of Madhuban Motors Pvt. Ltd. on the grounds that the lender unilaterally appointed the sole arbitrator, violating Section 12(5) of the Arbitration and Conciliation Act, 1996. Ruling that participation in arbitral proceedings cannot remedy an ineligible appointment, the Bench comprising of Justice Sandeep...

Apple Watch Bands Classified as Watch Straps, Not Smartwatch Parts: CAAR Mumbai

The Mumbai, Customs Authority for Advance Ruling (CAAR) in a ruling dated December 23 2025, has clarified that Apple Watch Bands (Leather and Non-Leather) could not be understood in its 'popular sense' as a part of Apple Watch. Apple's Watch has a host of functionalities such as timekeeping, storage of data, voice messages, heart beat sharing, sketching via a paired IPhone. Apple's...

Homebuyers Can Claim Interest For Delayed Possession Despite Project Deadline Extension: MahaRERA

The Maharashtra Real Estate Regulatory Authority (MahaRERA) has recently clarified that homebuyers are entitled to interest for delayed possession once the possession date promised in their agreements expires. This holds even if the regulator has extended the project's overall completion timeline. In an order dated December 26, 2025, a coram of Chairperson Manoj Saunik, allowed a batch of...

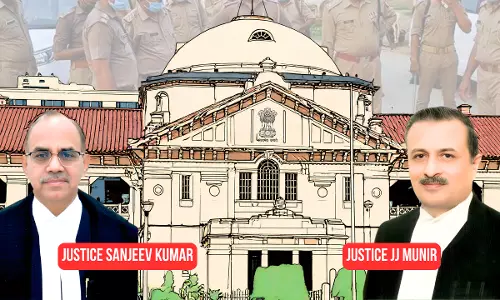

'Deceased Was Murdered By Someone Else': Allahabad High Court Acquits Murder Accused 38 Years After Life Imprisonment Sentence

Recently, the Allahabad High Court has acquitted 3 accused of murder and serving life imprisonment on grounds that the murder was a blind murder and was carried out by someone else. The Court held that there were major contradictions in ocular and medical evidence and the prosecution failed to prove its case beyond reasonable doubt.While acquitting the 3 accused, the bench of Justice J.J....

Excess Duty Paid On PCMX For Manufacturing Of Dettol Products Refundable As Prices Were Government Controlled: CESTAT Chennai

The Chennai Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) held that excess duty paid on PCMX (Para-Chloro-Meta-Xylenol) used for manufacturing Dettol products is refundable, as the prices of products were controlled by the Government. The bench opined that under such circumstances, the doctrine of unjust enrichment does not apply. Vasa Seshagiri Rao...

Review Power Not Inherent; Authority Becomes Functus Officio Once Final Order Passed: Patna HC Reinstates Panchayat Teachers After 10 Years

The Patna High Court recently set aside the orders of the state-level tribunals and reinstated two women Panchayat teachers in Buxar after nearly a decade-long legal battle. In doing so, the Court reiterated that the power of review is not an inherent attribute of a judicial or quasi-judicial authority and must flow from a specific statutory conferment.A Single Judge Bench comprising Justice...

Supreme Court Annual Digest 2025 - Lok Adalat

Adalat Code of Civil Procedure, 1908; Order XXI Rules 97, 99, and 101 — Powers of Executing Court regarding Lok Adalat Awards — Held, while these provisions enable an Executing Court to address incidental questions during execution (such as the extent of enforceability against a person in possession), they do not authorize the court to examine the validity of the award itself...

Tripura Student's Tragic Death: Plea In Supreme Court Seeks Recognition Of 'Racial Slur' As Hate Crime & Guidelines To Tackle Discrimination

Following the tragic death of a 24-year old student subjected to a racial attack in Dehradun over his north-eastern appearance, a public interest litigation has been initiated before the Supreme Court to address racial discrimination and violence against Indian citizens from north-eastern states and other frontier regions of India.The plea, filed by Advocate-on-Record Anoop Prakash Awasthi,...

AI-Powered MIKO-3 Smart Robot Classified As ADP Machine, Not Electronic Toy; Exempt From Basic Customs Duty: CESTAT Chennai

The Chennai Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) held that the AI-powered MIKO-3 smart robot performs the essential function of Automatic Data Processing (ADP) Machines and cannot be classified as an electronic toy merely because it offers learning or entertainment features. P. Dinesha (Judicial Member) and Vasa Seshagiri Rao (Technical Member)...

Including Dead Persons As Prosecution Witness Goes To Root Of Matter, Shows Non-Application Of Mind Rendering Probe Unreliable: Allahabad HC

The Allahabad High Court has held that investigation is rendered unreliable and legally unsustainable if dead persons are included as prosecution witnesses without any explanation.Justice Shekhar Kumar Yadav held “The inclusion of deceased persons as prosecution witnesses, without any explanation, goes to the root of the matter and reflects non-application of mind during investigation,...

Availability Of Civil Remedy Not Grounds To Quash Criminal Proceedings: J&K High Court Holds In Enso Tower Dispute

The High Court of Jammu & Kashmir and Ladakh recently held that the mere existence of a civil or commercial dispute does not bar criminal prosecution, if the allegations in a complaint disclose the commission of a criminal offense. Noting that same facts might result in both civil and criminal remedies, the bench comprising of Justice Sanjay Dhar, on 26th December, 2025, rejected to quash...