Corporate

NCLAT Orders Former Directors Of Gold Bullion Trader To Pay ₹16.78 Crore For Fraudulent Sales During Insolvency

The National Company Law Appellate Tribunal at New Delhi recently held that three suspended directors of Varsha Corporation Ltd, a gold bullion trading company, must personally contribute more than Rs 16.78 crore to the company's estate after finding that they carried out fraudulent gold sales while an insolvency petition against the firm was pending. A bench of Judicial Member Justice...

Delhi High Court Upholds DMRC's Arbitral Award Against Parsvnath Builders Amounting To ₹70 Lakhs

The Delhi High Court Bench of Justice Jasmeet Singh has upheld an arbitral award in favour of Delhi Metro Rail Corporation (“DMRC”) against Parsvanath Developers Limited (“PDL”) relating to development of commercial space in Tis Hazari Metro Station. The Court affirmed the view taken by the Arbitrator that DMRC was not in violation of its obligations under the Concession...

LiveLawBiz: Business Law Daily Round-Up: December 05, 2025

TAX Income Tax Appeal Cannot Be Rejected Solely For Assessee's Non-Appearance Before CIT(A): Kerala High Court Interest On Delayed Agricultural Income Tax Not Deductible U/S 37 Income TaxAct: Kerala High Court Income From Public Religious/Charitable Trusts Not Eligible For ExemptionU/S 10(23BBA) Income Tax Act: Kerala High Court Non-MonetaryBenefits From Manufacturer “Promotional” In...

Mere Forgery Claims Do Not Oust NCLT's Jurisdiction To Examine Disputed Company Records: Delhi High Court

The Delhi High Court has recently held that mere allegations of fraud or forgery cannot be used to oust the jurisdiction of the National Company Law Tribunal (NCLT). The court ruled that civil courts cannot entertain parallel suits when the same issues are already before the NCLT in an oppression and mismanagement case. A single bench of Justice Amit Mahajan, subsequently, set aside a...

Delhi High Court Rejects ITC's Plea To Restrain Adyar Gate Hotels From Using 'Dakshin' Mark

The Delhi High Court on Thursday rejected ITC Limited's interim plea to restrain Chennai-based Adyar Gate Hotels Limited from using the restaurant brand Dakshin. The court held that ITC had failed to establish territorial jurisdiction and had not made out a prima facie case of infringement or passing off. It said ITC could not rely on online reservations or the existence of their...

Supreme Court Refers 'Bharat Drilling' Judgment' To Larger Bench For Clarity Whether Prohibited Claims Bind Arbitral Tribunals

The Supreme Court on Friday referred its 2009 judgment in Bharat Drilling and Foundation Treatment Private Limited versus State of Jharkhand (2009) 16 SCC 705. to a larger bench, observing that the ruling has been repeatedly and incorrectly relied upon to dilute prohibitory clauses in government contracts. A bench of Justice P S Narasimha and Justice A S Chandurkar said the earlier decision...

MCA Redefines Small Company Criteria, Raises Paid Up Capital Cap To Rs 10 Crore and Turnover Cap To Rs 100 Crore

The Ministry of Corporate Affairs has revised the definition of small companies by increasing the turnover ceiling from Rs 40 crore to Rs 100 crore and the paid-up capital threshold from Rs 4 crore to Rs 10 crore.The notification was issued on December 1, 2025 which took effect immediately. The amendment updates the Companies (Specification of Definition Details) Rules, 2014. These rules...

Income Tax Appeal Cannot Be Rejected Solely For Assessee's Non-Appearance Before CIT(A): Kerala High Court

The Kerala High Court has held that an Income Tax Appeal cannot be rejected solely for the assessee's non-appearance before the Commissioner of Income Tax (Appeals). Justice Ziyad Rahman A.A. stated that none of the provisions in Section 250 of the Income Tax Act permit the appellate authority to reject the appeal on the ground of non-appearance of the assessee/appellant,...

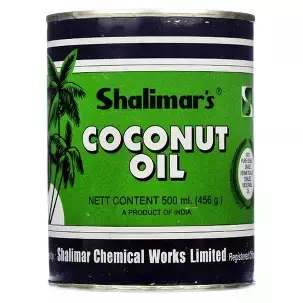

Calcutta High Court Says KMP Coconut Oil Packaging Looks Too Similar to Shalimar's, Upholds Injunction

The Calcutta High Court has upheld an interim injunction in favour of Shalimar Chemical Works Pvt. Ltd. that restrains Edible Products (India) Ltd., which sells coconut oil under the “KMP” brand, from using packaging the court found deceptively similar to Shalimar's long used trade dress. A division bench of Justice Sabyasachi Bhattacharyya and Justice Supratim Bhattacharya in an order...

Interest On Delayed Agricultural Income Tax Not Deductible U/S 37 Income Tax Act: Kerala High Court

The Kerala High Court has held that interest on delayed agricultural income tax is not deductible under Section 37 Income Tax Act. Section 37 of the Income Tax Act provides deductions on expenses which are directly related to a business's operations. Justices A. Muhamed Mustaque and Harisankar V. Menon examined whether the interest paid on account of the delayed payment...

No Medical Negligence Proven: NCDRC Rejects Complaint Against Northern Railway and Batra Hospitals

The National Consumer Disputes Redressal Commission, comprising Mr. Justice A.P. Sahi (President) and Mr. Bharatkumar Pandya (Member), held that no medical negligence or deficiency in service was proved against Northern Railway Central Hospital, Batra Hospital, or the treating doctors in relation to the treatment of the complainant's daughter, who died due to abdominal tuberculosis...

Income From Public Religious/Charitable Trusts Not Eligible For Exemption U/S 10(23BBA) Income Tax Act: Kerala High Court

The Kerala High Court has held that income derived from public religious/charitable trusts is not eligible for exemption under Section 10(23BBA) of the Income Tax Act. Section 10(23BBA) of the Income Tax Act, 1961, provides a complete exemption from income tax for the income of a body or authority that has been established, constituted, or appointed under any Central,...