All High Courts

Gujarat High Court Directs NID To Issue Mark-Sheet To Student Who Was Admitted Against Vacant Reserved Seat Under Interim Orders

The Gujarat High Court has directed the National Institute of Design (NID) to issue mark sheets and related academic documents to a student who completed his course after being granted admission against vacant reserved seats pursuant to a 2021 interim order.Granting relief, Justice Nirzar S. Desai observed:“It is an undisputed position that the present applicant has successfully passed out...

Transfer To Commercial Court Doesn't Bar Additional Written Statement Or Counterclaim If Leave Granted Under CPC: Calcutta High Court

Holding that the Code of Civil Procedure does not prohibit a defendant from filing an additional written statement or counterclaim with the leave of the court even after an earlier written statement has been submitted, the Calcutta High Court refused to interfere with an order of the Commercial Court accepting a fresh written statement along with a counterclaim after transfer of the suit....

Rape Case | Allahabad High Court Grants Bail To YouTuber Mani Meraj After Parties Agree To Marry Under Special Marriage Act

The Allahabad High Court on Tuesday granted bail to YouTuber and Comedian Mani Miraj, alias Ramdi Miraj Alam, who is facing serious allegations of rape, assault, unnatural offences and forced abortion. The order was passed by a bench of Justice Gautam Chowdhary after the informant/victim personally appeared before the Court and submitted a handwritten statement confirming a...

J&K&L High Court Grants Bail To Woman In UAPA Case; Says Mere Custody Of Cash Without Intent Doesn't Attract Terror-Funding Offence

Spotlighting the need to distinguish suspicion from culpable intent under anti-terror laws, the High Court of Jammu and Kashmir and Ladakh has held that mere receipt and safe custody of money, without proof of intention or knowledge to further terrorist activities, does not prima facie attract offences under Sections 38 or 40 of the Unlawful Activities (Prevention) Act (UAPA).The Division...

Mortgage By Conditional Sale Retains Debtor-Creditor Relationship, Distinct From Sale With Repurchase Option: Gujarat High Court

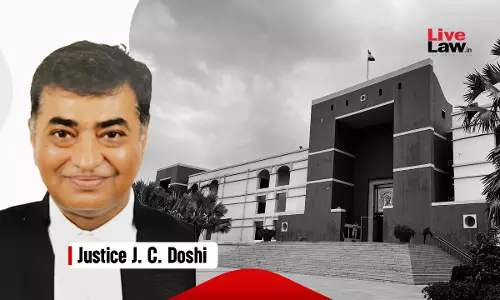

Emphasizing the distinction between a "mortgage by conditional sale" and a "sale with a condition to repurchase", the Gujarat High Court reiterated that a transaction which creates debtor-creditor relationship and right of redemption subsists in favour of mortgagor, must be treated as a mortgage with conditional sale. Justice J.C. Doshi referred to Supreme Court's decision in Patel...

Rajasthan High Court Upholds Eviction Of 40-Year-Old Shop Near Temple, Says Devotees Facing Inconvenience In Smooth Movement

The Rajasthan High Court has dismissed a petition challenging notice sent by Shri Devasthan Board, maintaining Shri Sarneshwar Mahadev Temple, to the petitioner to evict him from his 40 year-old shop structure in the close vicinity of the temple, observing that the petitioner was an encroacher. The bench of Justice Kuldeep Mathur held that the Board was well within its right to...

Debarment Cannot Be Lifelong, Penalty Must Be Proportionate: J&K&L High Court Allows Contractor To Seek Fresh Registration

Holding that debarment is never permanent and its duration must depend upon the gravity of the misconduct, the Jammu and Kashmir and Ladakh High Court has ruled that even where a contractor is found guilty of forgery and financial impropriety, punitive action cannot be allowed to operate endlessly. The Court underscored that penalties in contractual matters must remain proportionate,...

Ancestral Or Inherited Properties Can Be Attached Under PMLA: Delhi High Court

The Delhi High Court has held that ancestral or inherited properties can be attached under the Prevention of Money Laundering Act, 2002.“The statute does not carve out an exception for ancestral or inherited properties, and thus, they are not immune from attachment,” a division bench comprising Justice Navin Chawla and Justice Ravinder Dudeja said. The Court dismissed an appeal filed by...

Homemaker Doesn't 'Sit Idle', Law Must Recognize Economic Value Of Her Contribution To Domestic Relationship: Delhi High Court

The Delhi High Court has observed that a homemaker does not sit idle and the law must recognise the economic value of her contribution to the domestic relationship.Justice Swarana Kanta Sharma said that the assumption that a non-earning spouse is “idle” reflects a misunderstanding of domestic contribution, as describing non-employment as idleness is easy but to recognise the labour...

'Check Period' After Minor Punishment Illegal; Employee Entitled To Promotion Consideration : Madras HC

A Division bench of the Madras High Court comprising Justice C.V. Karthikeyan and Justice R. Vijayakumar held that the penalty cannot justify withholding promotion after punishment ends. Further the 'check period' concept is illegal after imposition of the punishment. Background Facts The employee was working in the School Education Department. He had been issued a charge memo,...

'Akin To Crime Thriller': Karnataka High Court Refuses To Quash FIR By Businessman Duped Of ₹200 Crore By Fake SBI Site

The Karnataka High Court refused to quash a cheating and cybercrime FIR against four persons accused of duping a businessman of over Rs. 200 Crore by allegedly creating a fake State Bank of India website, hacking the actual bank website and obtaining OTPs terming the case akin to a "crime thriller".The court was hearing petitions filed by four accused persons challenging FIR registered...

Madras High Court Directs DVAC To Register FIR Against Minister KN Nehru Based On Materials Supplied By ED

The Madras High Court on Friday (20th February) directed the Tamil Nadu Directorate of Vigilance and Anti-Corruption to register an FIR against Tamil Nadu Minister for Municipal Administration, Urban and Water Supply, KN Nehru, for alleged bribery in appointments to the Municipal Administration and Water Supply (MAWS) Department, based on information shared by the Enforcement Directorate....