Trending

Rajiv Gandhi School of Intellectual Property Law , IIT Kharagpur To Organise MCIP 6.0 On Interdisciplinary Dimensions Of Intellectual Property

The Rajiv Gandhi School of Intellectual Property Law (RGSOIPL), Indian Institute of Technology (IIT) Kharagpur, is set to organize the 6th Edition of the Masters Conference on Intellectual Property (MCIP 6.0) on 14th and 15th March 2026. MCIP is a flagship academic initiative of RGSOIPL that has, over the years, emerged as a premier platform for scholarly engagement, research dissemination and interdisciplinary dialogue in the field of Intellectual Property Law, both at the national and...

Industrial Court Proper Forum To Decide Issues Regarding Contract Labour : Supreme Court

The Supreme Court observed that the Industrial Court established under the Industrial Disputes Act, 1947 is the proper forum for adjudication of the dispute concerning the employment and termination of employment of the contract labour. “…the proper forum is the Industrial Court/Court for adjudicating issues concerning the employment and termination of employment of contract...

NLIU Bhopal Announces XIV International Mediation Tournament, 2026 – Mediation Plan Submission Stage Opens

The Centre for Alternative Dispute Resolution (CADR), National Law Institute University (NLIU), Bhopal, invites law students from across India and abroad to participate in the Mediation Plan Submission Stage of the XIV NLIU International Mediation Tournament (NLIU-IMT) 2026.About NLIU and CADREstablished in 1997, NLIU Bhopal is among India's premier national law universities. With the Chief Justice of Madhya Pradesh as its Chancellor, the university maintains strong institutional linkages with...

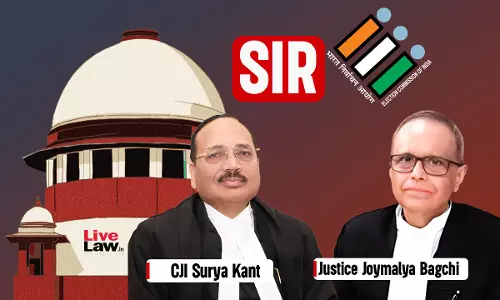

Supreme Court Reserves Judgment On Pleas Questioning Legality Of SIR

The Supreme Court today reserved the decision on a batch of petitions challenging the legality of the Special Intensive Revision (SIR) of the electoral rolls done by the Election Commission of India across several states. The Court is examining whether the ECI has the powers under Article 326 of the Constitution, the Representation of the People Act, 1950 and the Rules made thereunder to...

Nyāya Udghoṣh 2026: NLU Odisha's National Judgment Writing Competition & Conclave

The National Law University Odisha (NLUO) was established in the year 2009 under The National Law University Orissa Act, 2008 (Act 4 of 2008) passed by the Odisha State Legislature and commenced its academic activities in the academic year 2009-10. Within a short span of time, NLUO has made its mark as a University engaged in imparting socially relevant education. NLUO is ideally placed to learn from other law schools both in terms of their strengths and drawbacks. Drawing from these...

'Will US Authorities Cooperate If Indians Seek Information?' : Supreme Court Asks Pfizer On Plea To Access Indian Company's Docs

The Supreme Court today, while hearing a plea by US pharmaceutical giant Pfizer, asked whether foreign courts and Western Authorities would cooperate in providing information to India, when it comes to abiding by the principle of reciprocity. The bench of CJI Surya Kant and Justice Joymalya Bagchi was hearing the challenge to the Madras High Court order, which refused Pfizer to enforce...

Social Media and Erosion of Legal Ethics

The legal profession has historically been regarded as a noble and disciplined calling, founded on principles of integrity, restraint, and service to justice. Advocates are officers of the court and play a vital constitutional role in the administration of justice. Their conduct, both inside and outside the courtroom, is governed by strict ethical standards framed under the Advocates Act, 1961 and the Bar Council of India Rules. However, in recent years, an alarming trend has emerged that...

Tamil Nadu SIR | Supreme Court Directs Publication Of 1.16 Crore Names Served Notices Citing 'Logical Discrepancy'

The Supreme Court on Thursday passed directions to ensure transparency in the verification of 'logical discrepancy' list published during the Special Intensive Revision of the electoral rolls in Tamil Nadu.A bench comprising Chief Justice of India Surya Kant and Justice Joymalya Bagchi noted that approximately 1.16 crores persons, who were included in the draft voter roll, have been served...

Karnataka High Court Suggests Empowering Civil Courts To Stay Mutation Orders In Title, Possession Dispute Cases

The Karnataka High Court (Dharwad bench) has suggested empowering the Civil Court to pass interim measures staying mutation orders passed by revenue authorities under the State Land Revenue Act concerning properties involving possession or title disputes. This the court said would help avoid multiplicity of parallel proceedings and aide litigants, since a title dispute can only be adjudicated...

Continuity Of Service For Pension Benefits Preserved When Technical Resignation Is Followed By Immediate Rejoining Without Break: Orissa HC

A Division Bench of the Orissa High Court comprising Justice Dixit Krishna Shripad and Justice Sibo Sankar Mishra held that continuity of service for pension benefits is preserved under CCS (Pension) Rules when an employee submits a technical resignation and immediately rejoins the same post under the same employer without interruption. Background Facts The employee was appointed as...

Stray Dogs Case: Live Updates From Supreme Court Hearing

Supreme Court resumes hearing in the Stray Dogs case Bench: Justices Vikram Nath, Sandeep Mehta and NV Anjaria Yesterday, the Court deprecated as "vague" affidavits filed by certain states, noting that statistics of bite incidents were not provided...