Supreme court

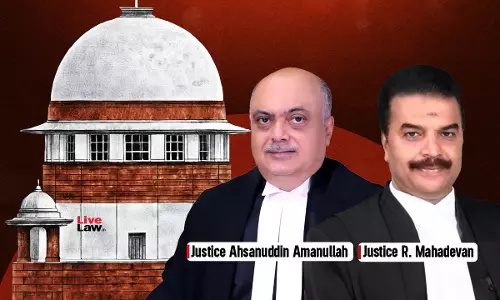

Non-Parties Liable For Contempt If They Knowingly Aid Disobedience Of Orders: Supreme Court

The Supreme Court has clarified that even persons who were not parties to the original proceedings can be held liable for contempt if they knowingly aid or facilitate the disobedience of a court order. The Court emphasised that once a person or authority becomes aware of a judicial order, deliberate inaction or assistance in non-compliance can amount to contempt of court.A bench of Justice Ahsanuddin Amanullah and Justice R. Mahadevan made the observations while dealing with contempt petitions...

Complete Supreme Court Annual Digest 2025 [Part-VII]

Industrial Disputes Act, 1947Section 2(oo)(bb) - The 73-year-old petitioner, a former employee, filed a Special Leave Petition under Article 136 of the Constitution challenging a labour dispute denial of reinstatement. Appearing in person due to financial constraints, he struggled with English submissions. The Court appointed Advocate Sanchar Anand as Amicus Curiae, who rendered pro...

Supreme Court Weekly Roundup: February 16, 2026 To February 22, 2026

JudgmentsPost-Bail Conduct Not Valid Consideration In Appeal Against Grant Of Bail : Supreme CourtCase Details: Balmukund Singh Gautam v. State of Madhya Pradesh and Anr.Citation: 2026 LiveLaw (SC) 158The Supreme Court observed that the conduct of an accused after a grant of bail cannot be a valid consideration while deciding an appeal against a grant of bail.“…post-bail conduct is never...

Supreme Court Daily Round-Up : February 27, 2026

Links to today's SC reports :SC Collegium Recommends Justice S.A. Dharmadhikari As Madras High Court Chief Justice; Justice Lisa Gill For Andhra Pradesh HCSupreme Court Collegium Approves Appointment Of Nine Advocates As Patna High Court JudgesAll States/UTs Framed Rules To Implement Shariat Act? Supreme Court Seeks ReportSC Collegium Adopts New Policy To Ensure Incoming HC Chief Justices...

IBC | Supreme Court Cautions Against Excessive Judicial Review, Criticises Trend Of Unsuccessful Bidders Seeking To Reopen CoC Decision

The Supreme Court today criticised growing trend of unsuccessful resolution applicants converting challenging almost every commercial decision of the Committee of Creditors under the guise of procedural impropriety and turning the insolvency process into a protracted adversarial contest.“The appeals before us typify the growing strategic use of the judicial system by unsuccessful...

Supreme Court Daily Round-Up : February 26, 2026

Links to today's stories :Supreme Court Bans NCERT Textbook With Chapter On Judicial Corruption, Issues Contempt Notice To NCERT Director & Ministry OfficialSupreme Court Expresses Reservations About 3-Year Practice Rule To Join Judicial Service, Says Women Affected'Marketing Labels Not Decisive For Tax Classification', Supreme Court Holds Rooh Afza Taxable As Fruit DrinkPune Porsche Case...

S.469 CrPC | Limitation Period Starts From Date When Offender's Identity Is Known & Not From Receipt Of Complaint : Supreme Court

The Supreme Court has observed that the period of limitation in criminal prosecutions begins from the date when the identity of all accused persons becomes known to the competent authority, and not from the date of the first complaint. A bench of Justices Ahsanuddin Amanullah and SVN Bhatti set aside the Kerala High Court's decision to quash the criminal proceedings under the Drugs and...

Deed Cannot Be Reinterpreted Based On Parties' Later Conduct When Terms Are Clear & Unambiguous: Supreme Court

The Supreme Court has cautioned against reliance on the ex-post facto conduct of parties to reinterpret a lease deed when the terms of the document are clear and unambiguous, holding that a lease validly established on the face of the deed cannot be altered or diluted by reference to the parties' subsequent conduct. “…courts must exercise far greater restraint when inferring the...

IBC Permits Parallel CIRP Against Debtor & Guarantor For Same Debt : Supreme Court

The Supreme Court on Thursday (February 26) observed that there's no bar under the Insolvency and Bankruptcy Code to initiate simultaneous CIRP against the corporate debtor and guarantor for the same debt. The bench of Justices Dipankar Datta and Augustine George Masih endorsed the findings of BRS Ventures Investments Ltd. v. SREI Infrastructure Finance Ltd. & Anr that "consistent with...

RTI Act Applies To Cochin International Airport Ltd : Supreme Court Upholds Kerala High Court Order

The Supreme Court today upheld the Kerala High Court order which held that the Cochin International Airport (CIAL) is a 'public authority' coming within the purview of the Right to Information Act, 2005.A bench of Justices Vikram Nath and Sandeep Mehta passed the order, after hearing Senior Advocate Mukul Rohatgi (for CIAL). It was of the view that the impugned order furthered transparency...

![Complete Supreme Court Annual Digest 2025 [Part-VII] Complete Supreme Court Annual Digest 2025 [Part-VII]](https://www.livelaw.in/h-upload/2026/02/25/500x300_658278-complete-supreme-court-annual-digest-2025.webp)