Trending

Confession Without Corroboration Cannot Be Basis For Conviction : Supreme Court

The Supreme Court on Tuesday (January 27) set aside the conviction in a murder case, upon finding that the conviction was based on the uncorroborated confessional statements made by the accused, in absence of a legal aid, before the magistrate. “…a confession can form a legal basis of a conviction if the Court is satisfied that it was true and was voluntarily made. However, it was also...

Excessive Land Acquisition Compensation To Some Landowners Cannot Invalidate Others' Compensation : Supreme Court

The Supreme Court on Tuesday (January 27) observed that an excessive disbursement of compensation to some beneficiaries in collusion with officials would not invalidate the compensation awarded to other beneficiaries. A bench of Justices Sanjay Kumar and K Vinod Chandran heard the case arising out of the Chhattisgarh High Court's decision that had set aside the land acquisition...

Karnataka High Court Denies Bail To PFI Member Booked For 'Conspiring' To Radicalize Muslim Youth To Commit Terrorist Acts

The Karnataka High Court refused to grant bail to a man accused of being a member of banned organization Popular Front of India (PFI) of allegedly conspiring to radicalise Muslim youth to carry out terrorist acts, as well as raising funds for the commission of terrorist activities. The court was hearing an appeal by Shahid Khan, one of nineteen accused, challenging dismissal of his bail plea...

Failure To Deliver Bed Set: North Goa Consumer Commission Directs Lakkadhaara To Refund ₹88,200 With Compensation

The North Goa District Consumer Disputes Redressal Commission at Porvorim, comprising Ms. Bela N. Naik (President) and Auroliano de Oliveira (Member), has directed Lakkadhaara Furniture Company to refund ₹88,200 along with ₹30,000 as compensation. The Commission held the company guilty of deficiency in service and unfair trade practice for failing to deliver a bed set within the...

"No End To Multiplication Of Cases In Family Disputes": Madras High Court Fines Father-In-Law For Filing Writ To Wreak Vengeance

The Madras High Court recently lamented the institution of multiple cases in family disputes and commented that instead of approaching the Family Courts to settle the disputes, parties often expanded the disputes to criminal courts and other jurisdictions and sometimes even the writ jurisdiction under Article 226 of the Constitution. Pointing out that there is no end to...

Supreme Court Requests Jharkhand HC CJ To Consider Plea To Enhance Retirement Age Of Judicial Officers

The Supreme Court today, while refusing to entertain a plea seeking enhancement of superannuation age of Jharkhand District Judges from 60 to 61 years, asked the Chief Justice of the High Court to consider the issue on the administrative side. The bench of CJI Surya Kant and Justices Joymalya Bagchi and R Mahadevan was hearing plea filed by District Magistrate Mr Ranjeet Kumar. As per...

Indo-Bangladesh Border Fencing: Calcutta High Court Directs State To Handover Land Acquired In Nine Districts To BSF By March 31

The Calcutta High Court on Tuesday (27 January) directed the West Bengal government to hand over by March 31, the land along Indo-Bangladesh Border (IB) in nine districts which it has acquired, to the Border Security Force (BSF) for the purpose of fencing.The directions were issued by the Division bench comprising Chief Justice Sujoy Paul and Justice Partha Sarathi Sen while considering a...

Allahabad High Court Rejects PIL Questioning Lowering Of NEET-PG 2025-26 Cut-Offs

The Allahabad High Court today rejected a Public Interest Litigation (PIL) plea challenging the decision of the National Board of Examinations in Medical Sciences (NBEMS) to reduce the qualifying cut-off percentiles for NEET-PG 2025-26 to zero percentile and a score of minus 40 for certain categories.A bench of Chief Justice Arun Bhansali and Justice Kshitij Shailendra rejected the PIL...

Non-Citizens Can File Writ Petition Against Arbitrary State Action: Madras High Court Sets Aside SBI's Termination Of Sri Lankan National

The Madras High Court has recently observed that a non-citizen can also file a writ petition under Article 226 of the Constitution challenging a State action if the same is allegedly arbitrary, making unreasonable discrimination and results in violation of rights guaranteed under Article 14 and 21 of the Constitution. “A non-citizen cannot invoke writ jurisdiction of this Court...

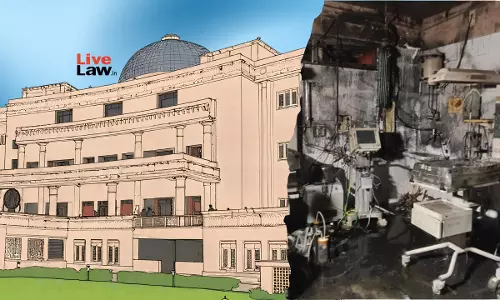

Jhansi Medical College Fire | Enquiry Pending For Over 1 Year: High Court Stays Suspension Of Ex-Chief Medical Superintendent

The Allahabad High Court (Lucknow Bench) recently stayed the operation of the suspension order passed against Dr Sunita Rathaur, the former Chief Medical Superintendent (CMS) of Maharani Laxmibai Medical College, Jhansi.The interim relief comes more than a year after her suspension order was issued following the unfortunate fire at the college's Neonatal Intensive Care Unit (NICU) that...