Trending

Rajasthan Bar Council Polls: Election Committee Terms BCI Show-Cause Notice For Supervision By Advocate General As 'Interference'

The High Powered Election Committee (Committee) supervising election process of the Bar Council of Rajasthan (BCR) has termed the show-cause notice issued by the Bar Council of India (BCI) to BCR's Acting Secretary over appointment of the Advocate General to oversee affairs of the state bar body as "interference".In doing so the Committee has said that BCI's show cause notice is "invalid"...

NLU Odisha Invites Registrations For Policy Presentation Competition Under Lexathon 2026; Register By March 10

National Law University Odisha is inviting you to the Policy Presentation Competition, organized in collaboration with Regstreet Law Advisors, a key event under LEXATHON 2026, NLUO's premier Tech Law Conclave, scheduled for March 28, 2026.About LexTechLexTech: Centre for Law, Entrepreneurship, and Innovation is a research center at NLUO dedicated to the intersection of law and emerging technologies. The center focuses on fields such as FinTech, AI, TMT, and Data Privacy, promoting...

'Conferences Won't Fix Justice System, Need More Judges, Infra': Allahabad High Court Acquits Murder Accused Who Spent 23 Yrs In Jail

The Allahabad High Court recently acquitted a man who spent approximately 23 years in jail on the charges of the gruesome murder of his wife and 3 children, as it concluded that the prosecution's evidence did not conclusively prove that the offence was committed by him. In its 10-page order, a bench of Justice Siddharth and Justice Jai Krishna Upadhyay said that the case was a sad...

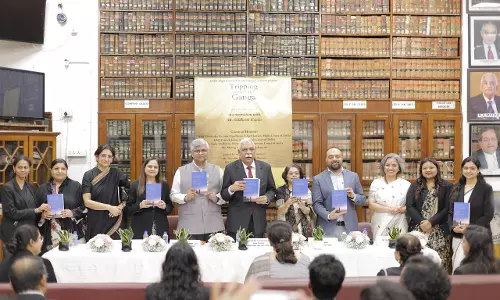

Delhi High Court Women Lawyers Forum Hosts Literary Evening On “Tripping Down The Ganga”

The Delhi High Court Women Lawyers Forum on Wednesday organised a literary event featuring a discussion on the book “Tripping Down the Ganga- A Son's Exploration Of Faith” authored by awyer turned writer Siddharth Kapila.The event was held at Bar room 18 in the Delhi High Court premises. The evening was attended by members of the judiciary, bar and literary community. Chief Justice...

Unnao Custodial Death: Delhi High Court Asks AIIMS To Examine Jaideep Sengar's Health After CBI Flags 'Fake' Cancer Prescriptions

The Delhi High Court has directed constitution of a Medical Board at All India Institute of Medical Sciences to independently assess the health condition of Jaideep Singh Senger, brother of Unnao rape case convict Kuldeep Sengar.A division bench comprising Justice Navin Chawla and Justice Ravinder Dudeja was dealing with Senger's application seeking interim suspension of his sentence on...

Ratio Et Oratio: VIT School Of Law To Host National Level Legal Debate Competition 2026; Register By March 7

The VITSOL Debate Society of VIT School of Law presents RATIO ET ORATIO, NATIONAL LEVEL LEGAL DEBATE COMPETITION, 2026. It is a premier undergraduate competition designed to cultivate rigorous argumentation, reasoned dialogue and ethical persuasion. The tournament adopts an innovative debating format, an evolution of classical Mace-style of debating infused with structural clarity, analytical depth and competitive fairness.It consists of uninterrupted speeches, a silent reflection window,...

Kerala High Court Directs State To Finalise SOP To Curb Overloaded Goods Vehicles On National Highways

The Kerala High Court has directed the State Government to finalise and implement the Standard Operating Procedure (SOP) for enforcement against overloading on National Highways.A Division Bench comprising Justice Raja Vijayaraghavan V and Justice K V Jayakumar issued the directions while disposing of a writ petition which sought implementation of measures to prevent overloading and...