High Courts

Madras High Court Upholds Trade Marks Registry Order Rejecting “Fresh Not Frozen” Mark

The Madras High Court has dismissed an appeal filed by Freshtohome Foods Private Limited, a Bangalore-based online grocery delivery platform against a 2019 order of the Trade Marks Registry rejecting its trademark application for the brand “FRESH NOT FROZEN”. Justice N Anand Venkatesh passed the order on December 18, 2025. The court held that the proposed mark was deceptively similar to...

'High-Handed Action By Officer': Gujarat High Court Directs Status Quo On Demolition Without Measurement Of Land

The Gujarat High Court on Monday (January 5) directed status quo over action of removal of alleged encroachment in Palanpur, observing that the Taluka Development Officer had acted in a high-handed manner when the area in question had not been measured and the petitioners were in possession of allotment document. The court also observed that the officer had placed reliance on a December 23,...

Bombay High Court Sets Aside Arbitral Award Passed With “Undue Haste” After Four-Year Delay

The Bombay High Court has set aside an arbitral award, holding that it was passed in undue haste after nearly four years of inaction and without giving the parties any opportunity of hearing.A Single Bench of Justice Sandeep V Marne found that the arbitrator acted with undue haste and in clear breach of natural justice. Rejecting the explanation offered for the long delay, the Court...

Rajasthan High Court Monthly Digest: December 2025

Citation: 2025 LiveLaw (Raj) 401 To 2025 LiveLaw (Raj) 430 NOMINAL INDEX Adnan Haider Bhai v State of Rajasthan, and other connected petition; 2025 LiveLaw (Raj) 401 Ravi v State of Rajasthan; 2025 LiveLaw (Raj) 402 Sayed Sarfaraj v Reserve Bank of India & Anr.; 2025 LiveLaw (Raj) 403 Rajasthan High Court Advocates' Association & Anr. v State of Rajasthan & Anr.;...

Madras High Court Rejects Minister I Periyasamy's Plea Against ED Probe, Tells Him To Approach PMLA Adjudicating Authority First

The Madras High Court has dismissed a plea filed by Tamil Nadu Minister for Rural Development I Periyasamy and his family members challenging an ECIR registered against them by the Enforcement Directorate in connection with a money laundering case. The bench of Chief Justice Manindra Mohan Shrivastava and Justice G Arul Murugan noted that the parties had filed the plea without...

Mere Apprehension of Business Loss In State Does Not Confer Writ Court Territorial Jurisdiction: Calcutta High Court

The Calcutta High Court has recently held that a petitioner's mere apprehension of business loss in West Bengal is not enough to invoke the court's territorial jurisdiction in a writ petition. A single-judge bench of Justice Om Narayan Rai, while dismissing a plea filed by a Kuwait company said that it is the infringement of a legal right that gives rise to a cause of action."The lis before...

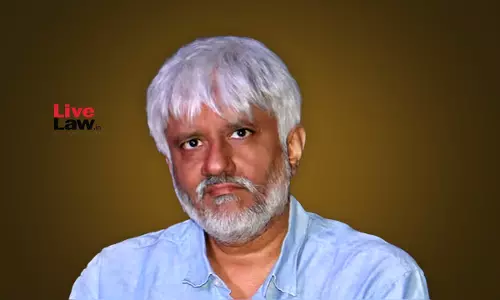

'Prima Facie Discloses Fund Siphoning': Rajasthan High Court Refuses To Quash Cheating FIR Against Filmmaker Vikram Bhatt, Others

The Rajasthan High Court rejected pleas filed by filmmaker Vikram Bhatt and other persons seeking quashing of a cheating FIR lodged against them, observing that the FIR at this stage "prima facie" disclosed allegations of siphoning, diverting and misappropriation of funds which cannot be treated as "mere breach of contract". The matter related to a FIR being filed against the...

Custodial Death Compensation: Kerala High Court Seeks Expeditious Finalisation Of SOP For Collection Of Prisoners' Legal Heirs Data

The Kerala High Court on Monday (05 January) directed the stakeholders to furnish their inputs to the Standard Operating Procedure (SOP) for the collection and verification of nominee/ legal heir details at the time of admission of prisoners in the State, so that the SOP can finalised at the earliest.The division bench comprising Chief Justice Nitin Jamdar and Justice Syam Kumar V M...

Mandatory Pre-Deposit For Customs Appeal Cannot Be Waived For Financially Sound Appellant: Karnataka High Court

The Karnataka High Court has held that the mandatory pre-deposit required to pursue a customs appeal cannot be waived for a financially sound appellant/importer. In a recently uploaded order pronounced on November 7, 2025, Justice M. Nagaprasanna said the pre-deposit under Section 129-E of the Customs Act does not deny access to justice. “It is a statutory discipline that applies uniformly...

Karnataka High Court Asks Centre To Consider Cashless CGHS Treatment For Emergencies, Critical Care Cases

The Karnataka High Court recently directed the Union of India to examine and consider, at the appropriate administrative level, the feasibility and phased implementation of a cashless medical treatment mechanism under the Central Government Health Scheme, particularly for emergency and critical care. A single judge, Suraj Govindaraj said, “A cashless treatment mechanism, particularly...

'Bhagavad Gita Reminds State Of Its Duty To Common Good': Punjab & Haryana High Court Orders Regularisation Of Daily Wagers

Emphasising that Indian constitutionalism is rooted in the civilisational idea of Rajdharma, where governance must be guided by justice, fairness and compassion, the Punjab and Haryana High Court has held that a welfare State cannot, in good conscience or law, continue to extract uninterrupted service from workers while keeping them in perpetual insecurity.Justice Sandeep Moudgil said, "There...

Long Incarceration No Ground To Allow Successive Bail When First Plea Rejected By Passing Detailed Order: Punjab & Haryana High Court

The Punjab and Haryana High Court has dismissed a second petition filed by an accused in the SFIO investigation into the Adarsh Group of Companies seeking regular bail, holding that while a successive bail application is not barred per se, however mere long incarceration cannot be the sole ground to allow the plea.Justice Manisha Batra said, "Though, a second/successive regular bail...